The World Bank’s December 2023 edition of the Nigeria Development Update (NDU), titled “Turning the Corner” captures vividly the economic situation in Nigeria, writes JOSEPH INOKOTONG.

The World Bank recently reported that Nigeria’s poverty level has gone up following the recent economic and fiscal reforms. The key reforms include the removal of petrol subsidy and the unification of the foreign exchange FX market.

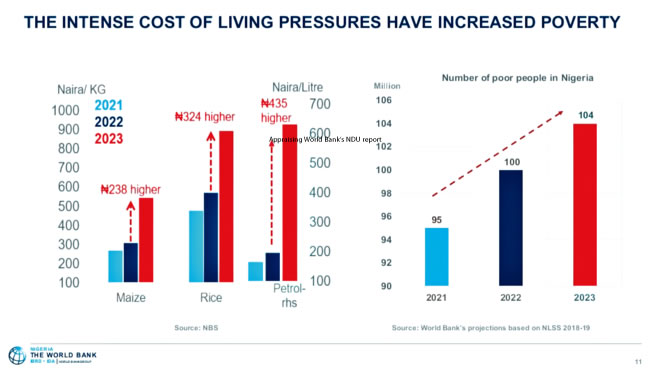

While commending the Federal Government for what it considered ‘bold reforms’ necessary to rescue Nigeria from the fiscal cliff, the World Bank described the current pains as temporary, stressing that the policies have created intense pressures on the cost of living, which have pushed more Nigerians into hardship, with 104 million of them now living below the poverty line.

According to the World Bank report, the number of poor people in Nigeria had grown from 95 million in 2021 to 100 million in 2022, while the National Bureau of Statistics (NBS), indicated that the figure was 82.9 million in 2019 and 85.2 million in 2020.

The Bank, in its December 2023 edition of the Nigeria Development Update (NDU), titled “Turning the Corner” that was released last week in Abuja said the Government of Nigeria avoided a fiscal cliff by implementing bold reforms, including ending the gasoline (premium motor spirit, PMS) subsidy, and shifting to a unified, market-reflective foreign exchange (FX) rate, noting that these essential reforms entail painful adjustments.

“They have led to an increase of retail gasoline prices by an average of 163 percent. The naira has depreciated against the US dollar by approximately 41 percent in the official market and by about 30% in the parallel market. To reap the benefits of the bold reforms and difficult but necessary economic adjustments now underway, it is essential to sustain and fully implement the reforms and take complementary actions”, the Bank pointed out.

This, the World Bank reiterated, is the key message from the December 2023 edition of the Nigeria Development Update, titled “Turning the Corner”. The report adds that the recently launched cash transfer intervention to cushion the impact of increased gasoline prices on the poor and vulnerable is providing welcome relief to a growing number of households, with five million households expected to be covered by the end of December.

The report stresses the need to continue with the reform momentum to complete the reforms and to address the costs of the reforms, as it noted that inflation remains at record high levels for Nigeria, 27.3 percent (yoy) in October 2023, partly driven by the one-off price impacts of the removal of the gasoline subsidy. It admitted that the impact of this is especially hard on poor and vulnerable citizens.

The FX market, the Bank rightly observed, has remained volatile and in a period of continuing adjustment to the new policy approach, with significant fluctuations in the exchange rate in both the official and the parallel markets. Revenue gains from the FX reform are visible.

However, it the stressed the need for more clarity on oil revenues, especially the financial gains of Nigeria National Petroleum Corporation Limited (NNPCL) from the subsidy removal, the subsidy arrears that are still being deducted, and the impact of this on Federation revenues.

Shubham Chaudhuri, World Bank Country Director for Nigeria, said, “The petrol subsidy and FX management reforms are critical steps in the right direction towards improving Nigeria’s economic outlook. Now is the time to truly turn the corner by ensuring coordinated fiscal and monetary policy actions in the short to medium term. Continued reform implementation can ensure that Nigeria benefits from the difficult adjustments underway. This includes ensuring that improved oil revenues following the sharply increased PMS price accrue to the Federation. In the medium-term, the economy will then begin to benefit from increasing fiscal space for development spending, including on power and transport infrastructure, as well as on human capital.”

The latest NDU report recommends specific actions required to further sustain and achieve the full benefits of reforms already embarked on by the Government. These include controlling inflation and improving the stability of the FX market; achieving fiscal consolidation by sustaining savings from the PMS subsidy reform and improving non-oil revenues; addressing structural barriers to growth, e.g. removing trade barriers.

Alex Sienaert, World Bank Lead Economist for Nigeria and co-author of the Report said, “With the continued implementation of macroeconomic stabilization reforms, Nigeria’s economy is expected to grow at an average annual rate of 3.5 percent in 2023-2026, or 0.5 percentage points higher than in a scenario where the reforms had not been implemented. In 2024, Nigeria has an opportunity to turn the corner to a more stable and predictable macroeconomic environment, and easier access to foreign exchange (FX) and imported inputs, which is critical to creating new jobs and lifting people out of poverty.”

The NDU report reads in part, “The removal of the subsidy was announced on May 29 and pump prices were adjusted on June 1. This results in expected fiscal savings of around N2 trillion in 2023 or 0.9 percent of GDP. Between 2023 and 2025, the expected gains are over N11 trillion, against a scenario in which the subsidy had continued’’.

The Minister of Finance and Coordinating Minister for the Economy, Mr Wale Edun while speaking on scrutinizing the NNPCL’s account, insisted that the account must be audited.

“There will be earnest scrutiny and I am sure NNPCL is getting ready for that. We want revenue to come into the government coffers from NNPCL and all other revenue agencies.”

The Minister’s position was lauded but that was not the first time such a statement would be made. Indeed, the last two Ministers of Finance, namely, Mrs Kemi Adeosun and MrsZainab Ahmed had publicly proclaimed that the accounts of the NNPCL would be scrutinised, but there has been no report of such an audit made public up till they left office.

Also, Mr. Edun disclosed that the Federal Government would come up with a new structure of salaries in 2024 but failed to give details, other than saying that it was statutory to review salaries every five years according to the Salaries and Wages Commission Act. He added that all stakeholders including Labour Union leadership would be involved.

Speaking on the huge FX in Domiciliary Accounts, the Minister of Finance disclosed that wealthy Nigerians were holding huge sums of dollars and other foreign currencies in their domiciliary bank accounts in the country. He noted that there was a lot of FX liquidity in Nigeria and the Federal Government would take steps to make holders of such accounts release the money. He was quick to add that the government would not force holders of such accounts to give them up but incentives would be provided to enable them to invest in attractive instruments, going forward.

On his part, the Governor of the Central Bank of Nigeria (CBN), Mr Olayemi Cardoso, who was a panelist during the NDU presentation, said that he was not against quasi-fiscal interventions by the CBN but that his focus would remain on how to reduce inflation through price stability. On the controversy around his failure to convene a Monetary Policy Committee (MPC) meeting since coming into office, he said that the past frequent MPCs did not achieve their objectives and that he would not continue along that line.

“To what extent did the meetings achieve their objectives? The answer is no. That is why we have chosen to do it differently. Holding these meetings take a lot of time and energy.” Mr Cardoso said.

He pointed out that his team holds Liquidity Management meetings every 8.00 am to review the liquidity situation in the system and that he would take every necessary action to mop up excess liquidity in the system, adding, “We have increased OMO (Open Market Operations) both in value and volume.”

Interestingly, in her contribution, the Minister of Industry, Trade and Investment, Doris Uzoka-Anite, countered the position of the World Bank on Power subsidy. The Bank had called for a power regime without subsidy to boost investors’ confidence and ensure a cost-reflective tariff.

However, Uzoka-Anite posited, “There is nothing wrong with power sector subsidy. A subsidy in the power sector is a subsidy that supports production. Countries everywhere support production and export.”

The World Bank said that FX unification has created a windfall for Federation revenues… yet, large deductions, as well as lower-than-expected gains from subsidy removal, have kept the Federation Account Allocation Committee (FAAC) revenues constant in percent of GDP terms.

The report says, “In recent years, Nigeria has filled financing gaps through contracting Ways and Means financing from CBN. This large-scale use of W&M contravened the CBN Act. Such deficit monetization is distortionary and inflationary. Up until May 2023, Nigeria had accumulated N26.9 trillion (or 11.6 percent of GDP) in Ways and Means financing. In June 2023, N22.7 billion of the stock was securitized allowing it to be considered official debt, reducing the interest rate, and increasing the tenor. Nigeria’s return to macroeconomic stability hinges in part on decisively ending the reliance on W&M from CBN”.

The NDU report may not reflect in its entirety the present situation in Nigeria but it is pertinent for the government and policymakers to adjust in conformity with the reality on the ground. After all, as the World Bank pointed out, the measures taken already to help the poorest and most vulnerable households cope with shocks through targeted cash transfers are a good start in redirecting the previous wasteful spending on the subsidy.

Hopefully, with continued reform implementation that stabilises the macroeconomic and fiscal situation and begins to generate more growth, jobs, and revenues, Nigeria will have more choices to make. This could include formulating and implementing a renewed compact to deliver social assistance, primary healthcare, basic education, and economic opportunities.

READ ALSO FROM NIGERIAN TRIBUNE