The Civil Society Legislative Advocacy Centre/ Transparency International Nigeria (CISLAC/TI-Nigeria), has tasked the incoming administration to implement reforms to deepen economic and export diversification, which will focus on manufacturing, with the target of improving the business climate and macroeconomic stability.

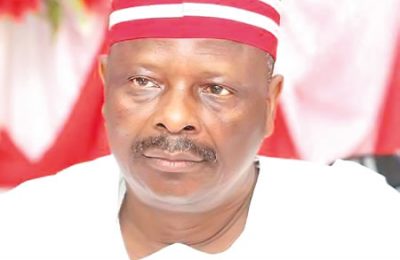

The Executive Director of CISLAC, Auwal Ibrahim (Rafsanjani), stated this on Monday while interacting with the media at the ongoing spring meeting of the World bank and the International Monetary Fund (IMF) in Washington DC, USA.

Rafsanjani, in a press release, noted that the incoming government needs to sustain strategic policies with the potential of driving economic growth and development.

He said deliberate efforts must be made to avert placement of priorities, reverse some of the current policies, sustain and effectively implement new ones.

To encourage long-term development, he noted that the government should also ensure that borrowing is done on conditions that are consistent with entrenching debt sustainability and that borrowed funds are wisely invested in the economy’s value-added sectors.

Rafsanjani also called for a need for Nigeria to operate an efficient tax administration that would ensure greater compliance to remittances devoid of all forms of evasions in the system to tackle revenue challenges.

He noted that the incoming government should prioritise engagement and enlightenment of taxpayers to educate them on their obligations; adoption of special tax drives and campaigns; aggressive anti-corruption policies and implementation; creating incentives to increase exports.

While calling on the incoming government to also reduce reliance on borrowings from the international capital market or commercial loans, he said there is a need to strictly adhere to the provision of the law on maintaining concessional loans as this poses limited debt risk and incorporates a mechanism to work out effective restructuring and negotiate debt relief initiatives which are quite impossible with commercial creditors.

He said: “Private creditors’ loans are expensive for a nation such as Nigeria that struggles with revenue generation and as such this frontier of borrowing should be discouraged.

“There is a need to strengthen the foreign exchange policy to reduce the impact of volatility on loan repayment and thereby reduce the public debt burden that arises from local currency devaluation.

“We have a long way to go towards revitalising the economy, but the incoming government needs to demonstrate the political will to at least ensure the transparent and accountable implementation of strategic and sustainable developmental policies.

“The Nigerian economy must at least grow at seven to eight per cent a year for five to 10 years based on an investment-led strategy to avoid the possibility of multi-dimensional poverty, debt, and insecurity consuming us in the next decade.

“Over the last decade, the country has spent over N10 trillion on fuel subsidies, about 15.5 trillion on capital expenditure, 2.5 trillion on health, and about 3.9 trillion on education.

He further called for an advance effort in implementation of the African Continental Free Trade Area (AfCFTA) to ensure that Nigeria is advantageously positioned to reap its substantial benefits to enhance the country’s productivity and competitiveness.

READ ALSO FROM NIGERIAN TRIBUNE