Parallex Bank has secured the sum of $10million trade finance facility from the Africa Export Import Bank (Afreximbank).

This is part of Afreximbank’s commitment to supporting the growth and development of financial institutions in the region.

The funding is provided through Afreximbank’s Trade Facilitation Programme (AfTRAF) which is part of its strategy to help African banks improve and supplement existing trade finance lines.

According to a statement from the bank, this facility will be deployed through on-lending, access to cross-border trade finance for small and medium-sized enterprises (SMEs) and to create lines of credit for businesses operating in the renewable energy solutions, health, education, agriculture and export industry.

It will also finance pan-African business opportunities for the growing SME segment of Parallex Bank.

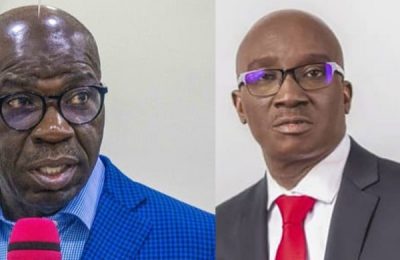

Speaking on the funding, Professor Benedict Oramah, the President of Afreximbank, said, “We are pleased to be expanding the AfTRAF programme across Africa. This financing facility provided to Parallex Bank, comes in addition to other trade facilities already in use by other partner banks in Nigeria and throughout the continent to help bridge the financing gap created by the withdrawal of foreign correspondent banks.”

The MD/CEO of Parallex Bank, Mr Olufemi Bakre, in his remarks, stated that the facility underscored the confidence Afreximbank had in the financial institution and will help it to materialise its strategy of building ecosystem partnerships to support critical sectors of Nigeria’s economy for growth and development.

Parallex Bank will also receive support in capacity building, technical assistance and other training programmes.

Recently, Afreximbank signed a Memorandum of Understanding with the Chartered Institute of Bankers of Nigeria (CIBN) on capacity building in “Trade and Finance.”

READ ALSO FROM NIGERIAN TRIBUNE