THE Nigeria National Petroleum Corporation Limited (NNPCL) has released its 2023 Audited Financial Statement (AFS), declaring a net profit of N3.297 trillion at the close of the financial year which ended in December 2023, an increase of over N700 billion (28 percent) when compared to the 2022 profit of N2.548 trillion.

This was just as the Group Chief Executive Office of the Corporation, Mr Mele Kyari denied subsidy payment on petrol.

In a world press conference held at the NNPC Towers in Abuja on Monday, the Chief Financial Officer of the Company, Mr. Umar Ajiya said the release of the AFS is a testament to the Company’s commitment to transparency and accountability.

“Our fiscal performance reflects both strategic foresight and operational resilience. Despite inherent challenges of our operational and economic environment, we have improved the productivity and the financial performance of this great company,” the CFO stated.

Ajiya added that posting such impressive returns demonstrates NNPC Ltd’s commitment to sustaining profitability and supporting the attainment of national energy security as stipulated by the Petroleum Industry Act (PIA) 2021, and by extension, as expected by the Company’s shareholders.

Explaining that NNPC Ltd will announce an Initial Public offer (IPO) once the shareholders and Board make a decision, Ajiya also debunked claims on subsidy payment, saying the Company was only taking care of PMS importation shortfall between it and the Federation.

Speaking earlier at the press conference, the Chairman of the NNPC Ltd Board, Chief Pius Akinyelure said that the excellent performance came as the fruit of the PIA 2021, the commitment of the Board, Management, and staff of the company.

Akinyelure added that the shareholders of the company have since approved a final dividend of N2.1 trillion in line with PIA 2021 provisions.

In her remarks at the briefing, the Executive Vice President, of Upstream, Mrs Oritsemeyiwa Eyesan said with improvements witnessed as a result of the renewed vigour in the war against crude oil theft and pipeline vandalism, NNPC Ltd is targeting two million barrels per day crude oil production by the end of the year.

On the current fuel queues in parts of Lagos and the FCT, the Executive Vice President, of Downstream, Mr Dapo Segun appealed for understanding from Nigerians, saying that the Company is working with relevant stakeholders to address the distribution, evacuation, and logistics challenges.

It would be recalled that in 2021, NNPC declared profit in its operations for the first time. From a loss position of N803 billion in 2018, it reduced the loss further down to N1.7 billion in 2019.

However, in 2020, it posted its ‘first-ever’ profit of N287 billion, then in 2021, it recorded N674.1 billion profit, and in 2022, the profit grew to N2.548, an unprecedented achievement in its financial performance. The N3.297 trillion profit declared for 2023 is the highest since the Company’s inception, 46 years ago.

The experts pointed out that the subsidy came back effective in July 2023 as soon as the Federal Government devalued the Naira.

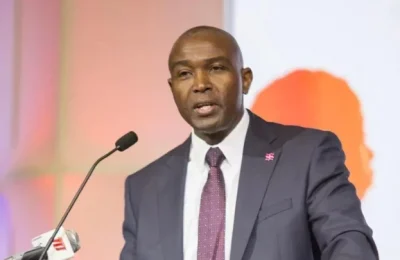

Meanwhile, the Group Chief Executive Officer (GCEO) of the NNPC Limited, Mr. Mele Kyari has denied subsidy payment on the Premium Motor Spirit (PMS).

The denial came after news had been making rounds that President Bola Tinubu had approved the NNPCL to use the taxes, royalties, and other funds that are supposed to be remitted to the Federation Account to defray the fuel subsidy cost on the PMS import.

However, following the forecast that the cumulative petrol subsidy bill between August 2023 and December 2024 will hit N6.884 trillion by December 2024, with the NNPC Ltd unable to remit N3.987 to the Federal Government, experts in the sector have expressed concern about the issue, saying that “petrol subsidy is back with a vengeance.”

Speaking with reporters on Monday in Abuja, Mr. Kyari said, “There is no subsidy whatsoever. We are recovering our full cost from the products that we import. We sell to the market.

“We understand why the marketers are unable to import. We hope that they do this quickly and this is some of the interventions the government is doing. There is no subsidy.”

President Bola Tinubu is reported to have approved a request by the NNPC Ltd to utilise the 2023 final dividends due to the Federation to pay for petrol subsidy,

The president was said to have also approved the suspension of the payment of 2024 interim dividends to the federation in order to augment NNPC’s cash flow.

In addition, the national oil company told the president it will be unable to remit taxes and royalties to the federation account for now because of the subsidy payments, which it termed “subsidy shortfall/FX differential”.

However, speaking with Nigerian Tribune, Practitioner/Consultant in the Oil and Gas industry, Dr. Henry Adugun, said that the subsidy bill could hit N8 trillion and not N6.8 trillion by December 2024 based on the consumption per day and production price differential.

He noted that NNPC has been struggling by carrying the burden of petrol supply in Nigeria without having money to pay for imports.

“NNPC is denied its own traders money. The reason NNPC doesn’t have supply in the market is because it is not giving traders money. Traders can’t supply a product that doesn’t exist.

“This has continued for a period of three months now. Out of NNPC’s 11 suppliers, four or five have opted out.”

According to Adigun, scarcity of petrol would persist until the acknowledgment of subsidy and valid means of payment or the market is completely liberalised.

Apart from impacting the economy, he said that Nigerians have been bleeding as the lack of remittance by NNPC persists.

He added that it’s illegal for the Federal government to ask NNPC to pay dividends.

“If you increase fuel price, inflation will gallop again. it is about 33.8 percent now,” he said.

He called on the federal government to allow transparency in the process of petrol import and supply

“What is the true cost of petrol? What is the current foreign exchange!. How can you switch people to other forms of energy? How do we make them to other ways of thinking?

“It is either the government liberalizes the sector through the downstream or provides an alternative source of energy. Tell people the truth,” Adigun said

Former Chairman, of the Major Energies Marketers Association of Nigeria, Adetunji Oyebanji, said there was no way NNPC’s cash flow would not be impacted having been the company absorbing the difference between what the price of the product should be and what is being sold.

“From the point of business, if NNPC is absorbing such huge expenses, it will have an impact on its cash flow. It may not be able to pay dividends and settle liabilities to suppliers. Its cash will be constrained; NNPC is using its cash to make up for the shortfall. This will put NNPC in a very precarious position,” he said.

“Maybe that is why the company is saying it will not be able to pay dividends or royalties or taxes to the government,” he said.

READ ALSO: Food insecurity: Army deploys officers to protect farmers in the north