The Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) has said that its position on the Tax Reform Bills aligns seamlessly with President Bola Tinubu’s vision for a more equitable and sustainable fiscal framework.

The Commission highlighted that it is not opposed to President Bola Tinubu’s reforms.

The RMAFC clarified that as a responsible and patriotic institution, the Commission has been actively engaged in the reform process as it draughted a comprehensive memorandum outlining it’s position, which emphasises adherence to global best practices.

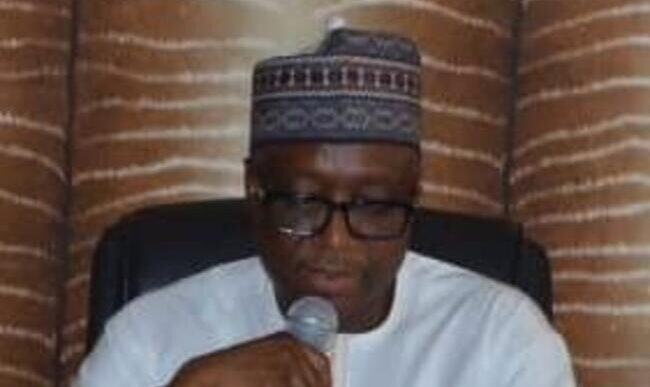

Addressing a press conference on Tuesday in Abuja, Mohammed Bello Shehu, Chairman of RMAFC, said, “Our stance aligns seamlessly with Mr. President’s vision for a more equitable and sustainable fiscal framework. We applaud President Tinubu’s strong commitment to repositioning Nigeria’s revenue base and his bold initiatives to address the country’s fiscal challenges.”.

Stating the true position of the RMAFC on the four bills in respect of the Tax Reform and Fiscal Policy Bill now at the National Assembly for deliberation, Mohammed Bello Shehu said, “I am compelled to address the grossly misleading reports circulating in the media, alleging that the Revenue Mobilisation Allocation and Fiscal Commission (RMAFC) ‘vehemently rejected’ President Bola Ahmed Tinubu’s proposed tax reform bill.” I am here to categorically debunk this report as not only false but also malicious.”

The Chairman of RMAFC further stated that “the proposed tax reform bills are a significant step towards integrating untapped revenue sources, enhancing Nigeria’s revenue-to-GDP ratio, and positioning the country favourably among nations with high fiscal performance.

“It is disheartening to note that despite our explicit support for the proposed legislation, some people have chosen to peddle falsehoods for reasons best known to them. These inaccurate statements can undermine the ongoing efforts of patriotic Nigerians who are tirelessly working to support the President in achieving his vision for the country.

“The proposed bill is currently undergoing a consultation process, which is why the President has forwarded it to the National Assembly following a public hearing. It is essential that people see professional advice from expert bodies for what they truly are and not be misinterpreted or taken out of context. It is unfair for anyone to come up with such a report at a time like this.

“As a Commission, we urge the public to disregard these baseless reports and rely solely on official documents and statements. We also implore the media to uphold the sacred standards and ethics of their noble profession. Let us collectively eschew fake news and instead seek truth, accuracy, and fairness in all our reporting.

“Once again, we reiterate our total support for the tax reform, which aligns with our goal of helping the President in his ongoing fiscal reforms. We acknowledge our responsibility to provide professional guidance whenever necessary and pledge to continue working tirelessly to support the president’s vision for a more prosperous Nigeria.

“It is important to recognise that the RMAFC is a critical stakeholder in Nigeria’s fiscal framework. Our mandate is to ensure an equitable revenue-sharing formula among the three tiers of government. We take this responsibility seriously and are committed to providing expert advice to support the government’s fiscal policy objectives.

“In this regard, we have been working closely with the National Assembly to provide technical input on the proposed tax reform bills. Our goal is to ensure that the legislation is robust, effective, and aligns with global best practices.

“We believe that the proposed tax reform bills have the potential to transform Nigeria’s fiscal landscape. The bills aim to promote fiscal equity, reduce tax evasion, and increase revenue generation. These objectives are in line with the RMAFC’s mandate, and we are committed to supporting their implementation.

“However, we also recognise that the tax reform bills are not without their challenges. There are concerns about the potential impact on businesses, individuals, and the broader economy. As a responsible commission, we are committed to addressing these concerns through constructive engagement with stakeholders.

“Reports claiming that the Commission opposes the bill are entirely unfounded and seem to be an attempt to stir up unnecessary controversy. At this critical juncture, the President needs the support of all Nigerians.

“The Commission’s stance on the proposed legislation is clear, and it is essential to rely on factual information to avoid spreading misinformation.”.

He acknowledged that the bill, for some reason, has sparked intense debates within the last few weeks, with the contentious issue of value-added tax (VAT) allocation and derivation taking centre stage.

The Chairman of RMAFC urged all Nigerians to remain vigilant and focused on the bigger picture and work together to support the President’s vision for a more prosperous Nigeria.

Mohammed Bello Shehu seized the opportunity to appeal to the media to be circumspect in their reportage, eschew fake news, promote factual reporting, and engage in constructive dialogue to achieve shared goals.

READ MORE FROM: NIGERIAN TRIBUNE