On Wednesday, the New Nuclear Watch Institute (NNWI) in London released a report on the Small Modular Reactor (SMR) market. Titled “Scaling Success: Navigating the Future of Small Modular Reactors in Competitive Global Low Carbon Energy Markets,” it positions SMRs as essential for mid-century net-zero goals. The report underscores the critical role of SMR deployment speed in enhancing the nuclear sector’s global competitiveness and achieving net-zero targets.

To meet the 1.5°C global warming limit, it’s estimated that nuclear capacity needs to triple from the current 370 GWe to around 1,000 GWe by 2050, replacing fossil fuel-fired plants as a source of dispatchable power generation. While large nuclear plants with conventional gigawatt-size reactors will account for the bulk of capacity additions, SMRs (Small Modular Reactors) are uniquely suited for smaller, decentralized grids, remote areas with limited renewable energy potential, and applications like district heating, seawater desalination, and industrial heat supply, offering, at least at present,the only practically viable decarbonisation solution.

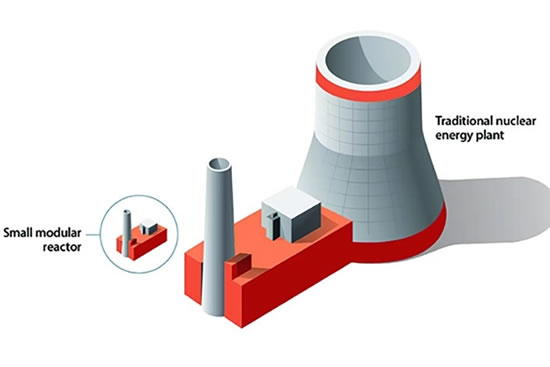

The UN nuclear watchdog, the International Atomic Energy Agency (IAEA), defines small reactors as those with a capacity not exceeding 300 MWe. However, some classifications also include larger reactors of up to 500 MWe. Reactors smaller than 10 MWe are termed “microreactors”.

The NNWI report estimates that by 2050, the global SMR fleet will have an installed capacity of approximately 150-170 GWe, accounting for 15-20% of the total nuclear capacity. It is expected that about one third of this SMR capacity will be in the United States and Canada, nearly one quarter in China, and another quarter across the emerging markets of Africa, Asia, and Latin America. Europe, however, is projected to constitute only 5-6% of the global SMR fleet in terms of operational capacity.

NNWI Chair Tim Yeo, former UK energy minister and MP, said:“Policy support for SMR technologies must be ramped up and carefully targeted to ensure we meet our mid-century net zero goals and facilitate timely completion of the clean energy transition. The current US-led policy shift towards growing support for SMR deployment is positive but needs to be amplified to ensure competitiveness”.

The report projects that a global SMR capacity of 150-160 GWe by 2050 would require an investment of about US$800-900 billion over 25 years. Early-stage state support and subsidies, estimated at US$150 billion, are crucial for sector growth and commercial viability. The majority of investments must precede the scale of deployment where SMRs are economically self-sustaining, driven by market forces alone. This base-case scenario underscores the need for substantial initial financial support to achieve projected growth.

“The world needs an initiative of the magnitude of the Marshall Plan to help the most carbon intensive regions replace their ageing coal fired plants with SMRs”, Mr Yeo added.

According to NNWI, given the intense competition and the limited market size, securing a first-mover advantage will be crucial in the SMR sector. The report emphasises that rapid, serial deployment will be a key driver of success in this market.Late entrants, even those with more advanced technology, are likely to find it harder to scale up. NNWI’s study recommends that substantial support should extend beyond R&D and licensing to include measures explicitly aimed at boosting fast series SMR rollout.

Policy measures aimed at promoting SMRs should focus on their practical applications, – the report says, – like replacing coal-fired plants to provide baseload capacity in electrical grids. Additionally, specialised support mechanisms could be developed for district heating and off-grid power and heat supply, particularly for mining operations and remote communities.

The report highlights 25 promising SMR projects, suggesting that the market will eventually be dominated by about six designs. Russia’s Rosatom, with robust government backing and an integrated service model, is poised to expand its dominance from large-scale nuclear reactors to the SMR sector. Its flagship RITM design series, capitalising on innovative features enabling versatile cogeneration applications and higher utilisation rates, is expected to capture the largest global market share by 2050, about 17-18% of the world’s total installed capacity. The Chinese Linglong One design, along with American designs NuScale’s VOYGR, GE-Hitachi’s BWRX-300 and XE-100, X-energy’s advanced high temperature reactor are also listed among the frontrunners.

The New Nuclear Watch Institute is the first think tank focused on the international development of nuclear energy. It believes nuclear power is vital for the achievement of the legally binding Paris Agreement objectives and an essential part of the global solution to climate change. Founded in 2014 by Tim Yeo, a former British energy and environment minister, the Institute aims to promote, support and galvanise the worldwide community to fight the greatest test of our time – climate change.