Low level of insurance acceptance in Nigeria is a recurring issue due to seemingly lack of trust, cultural factors, among others. SEGUN KASALI writes on how insurance can be deepened and accepted in the country.

INSURANCE as a form of risk management seeks to protect people from financial loss, where in exchange for a fee a party agrees to compensate another party in the event of a damage, loss or injury. This had long been widely accepted and recognised as a life-saving mechanism or approach all over the world.

Historically, the Chinese and Indian traders had been practicing the distribution or transfer of risk since the third and second millennia BC, respectively. The Chinese merchants travelling treacherous river rapids would redistribute their wares across many vessels to limit the loss due to any single vessel capsizing.

The ancient Greeks, in the same vein, had marine loans; money was advanced on a ship or cargo to be repaid with large interest if the voyage prospers. Meanwhile, the money would not be repaid at all if the ship were lost, thus making the rate of interest high enough to pay for not only for the use of the capital but also for the risk of losing it.

This protection mechanism called insurance had long been the ways of life of Western countries like the United Kingdom, the United States of America, Canada and many others to the extent that in applying for Visa to European countries, one of the required documents to be submitted is travel insurance.

It is estimated that about 30 percent of people in the UK have life insurance, equal to around 20 million people, eight million households and 1.1 million mortgaged properties. More people were insured in 2022 than 2021. In 2022, 92.1 percent of people or 304.0 million, had health insurance at some point during the year, representing an increase in the insured rate and number of insured from 2021 (91.7 percent or 300.9 million).

In 2022, 27 million Canadians were covered by supplementary health insurance, while 20 million opted for coverage for accidents and other reasons. In contrast, only 12 million individuals had coverage in the event of a disability.

Besides its protection nature, insurance contributes greatly to the employability and the economic growth of any nation. According to the Association of British Insurers’ (ABI) latest ‘Total Tax Contribution Survey,’ the insurance and long-term savings industry has contributed a record £17.2 billion to the UK economy in tax in 2021-22.

In the survey carried out by PwC for the ABI, the sector contributed 6.9 percent more in tax in 2021-22 than in 2019-20, marking the highest amount since the study began. The record figure proves that despite rising inflation and market volatility, the industry has continued to significantly contribute to the UK economy, supplying 2.1 percent of the government’s tax receipts for the period.

The total contribution comprises £4.8 billion of taxes borne, such as corporation tax irrecoverable VAT and employment tax and £12.4 billion of taxes collected through Insurance Premium Tax (IPT), employee income tax and National Insurance Contributions.

Amidst these humongous benefits accrued to individuals and nation, insurance is still being greeted with resentment in Nigeria. According to reports, only about five million Nigerians, representing three percent of the population have insurance coverage through the Mational Health Insurance Scheme (NHIS) and these are mostly members of the formal sector, particularly federal civil servants. Against this background, efforts are being intensified in different quarters of the country to ensure that insurance gains prominence.

Agency approach will increase insurance penetration in Nigeria – Mokobi

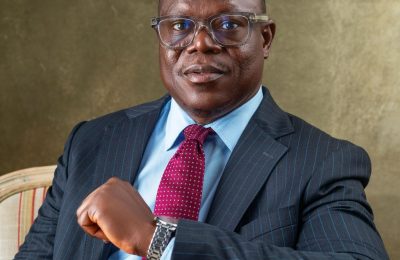

At a recent event in Lagos, the Chief Executive Officer, Prudential Africa, Emmanuel Mokobi, disclosed that agency approach will be leveraged upon to increase insurance awareness in the country.

He explained that the agents will visit people and orientate them on how to go about it.

Mokobi pointed out the lowness in insurance penetration in the Nigeria as it contributes less than 0.2 percent of gross domestic product (GDP), harping on the significant runway for growth.

The Chief Executive Officer of Prudential Africa, who noted that the country’s life insurance market is the fifth largest in Africa grossing $770 million premium, said the firm has established its presence in Nigeria, hence, the acquisition of the remaining stake in Prudential Zenith Life Insurance Limited in order to fully realise the potential of the business.

According to him, the company intends to build sustainable, multi-channel growth platform through targeted investments in markets.

He emphasised on the company’s relationship with Zenith Bank with over 400 branches and a customer base of nearly 29 million, citing the effectiveness of their bancassurance partnership and the promises to deliver innovative insurance solutions.

Mokobi, therefore, expressed gratitude to the teams and partners for dedication, assuring of building a future where every life is protected and future secured.

“Insurance penetration remains low in Nigeria at less than 0.2 percent of GDP. The runway for growth is significant. Nigeria’s life insurance market is the fifth largest in African with a gross written premium is $770 million and we have an established presence here.

“Prudential’s acquisition of the remaining stake in Prudential Zenith Life Insurance Limited will enable us to fully realise the potential of this business. Our strategy in Africa remains clear: we aim to build a sustainable, multi-channel growth platform through targeted investments in markets rich in structural growth opportunities of which Nigeria is central.

“At the heart of this approach lies our valuable relationship with Zenith Bank, one of Nigeria’s leading banks. With over 400 branches and a customer base of nearly 29 million, Zenith Bank affords us unparalleled access to a broad and diverse clientele.

“Our bancassurance partnership has proven to be an effective distribution channel and with this acquisition, we will further enhance this partnership to deliver innovative insurance solutions that cater to the unique needs of our customers.

“As we embark on this new chapter, I want to express my gratitude to our teams and partners for their unwavering dedication. Together, we are committed to building a future where every life is protected and every future is secure.

“With this acquisition, we are not just deepening our investment in Nigeria; we are reinforcing our commitment to serving its people. We envision a future where everyone has access to the life insurance products they need to secure their families and futures,” he said

We provide life, health insurance and asset management across Asia, Africa – Solmaz

In a show of proof of the company’s ability in penetrating insurance hugely, the Managing Director, Strategic Business Group, Prudential, Solmaz Altin, noted that the company provides life, health insurance and asset management across Asia and Africa.

Solmaz stated that the company positioned itself to be trusted partner and protector for generations via the provision of simple and accessible financial and health solutions.

According to him, the business has dual primary listings on the Stock Exchange of Hong Kong (2378) and the London Stock Exchange (PRU).

He added that it also has a secondary listing on the Singapore Stock Exchange (K6S) and a listing on the New York Stock Exchange (PUK) in the form of American Depositary Receipts.

Altin described it as a constituent of the Hang Seng Composite Index and is also included for trading in the Shenzhen-Hong Kong Stock Connect programme and the Shanghai-Hong Kong Stock Connect programme.

“Prudential Plc provides life and health insurance and asset management in 24 markets across Asia and Africa.

“Prudential’s mission is to be the most trusted partner and protector for this generation and generations to come, by providing simple and accessible financial and health solutions.

“The business has dual primary listings on the Stock Exchange of Hong Kong (2378) and the London Stock Exchange (PRU). It also has a secondary listing on the Singapore Stock Exchange (K6S) and a listing on the New York Stock Exchange (PUK) in the form of American Depositary Receipts.

“It is a constituent of the Hang Seng Composite Index and is also included for trading in the Shenzhen-Hong Kong Stock Connect programme and the Shanghai-Hong Kong Stock Connect programme.

“Prudential is not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America, nor with The Prudential Assurance Company Limited, a subsidiary of M&G Plc, a company incorporated in the United Kingdom,” he said.

Prudential’s acquisition of the remaining stake in Prudential Zenith Life Insurance Limited will help to deepen insurance penetration in Nigeria, aside ensuring full realisation of the potential of this business.

READ ALSO: Ebonyi: Court sentences man to death over motorcycle, phone theft