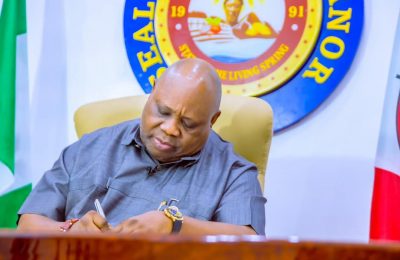

The Governor of the Central Bank of Nigeria (CBN) Olayemi Cardoso assumed office on Friday, September 22, 2023. CHIMA NWOKOJI reflects on the achievements of his administration highlighting key accomplishments and outlining the direction for the future.

A year ago, Olayemi Cardoso assumed office as the Governor of the Central Bank of Nigeria (CBN), stepping into a pivotal role at a critical time for the Nigerian economy.

As the head of the CBN, Cardoso faced a myriad of economic challenges—ranging from inflationary pressures and a volatile foreign exchange (FX) market to mounting debt and concerns over financial inclusion. Now, a year into his tenure, the impacts of his reforms are beginning to reshape Nigeria’s financial system.

One of Cardoso’s earliest and most significant reforms has been in the foreign exchange market. Prior to his tenure, banks had been borrowing heavily from the CBN to purchase foreign exchange, a practice that exacerbated pressures on the Naira and fueled inflation. The Nigerian economy suffered from multiple exchange rates, which caused significant market distortions, made business planning difficult, and undermined investor confidence.

Cardoso’s administration introduced reforms that unified the FX market, eliminating the arbitrage opportunities that had plagued the system. By introducing transparency in FX transactions and addressing backlogs of FX obligations, Cardoso has improved liquidity and restored some measure of stability to the Naira.

In fact, as of July 2024, Nigeria’s external reserves had risen to $37.9 billion, up from $33.6 billion in October 2023, a reflection of the improved confidence in Nigeria’s external financial obligations.

Bismarck Rewane, CEO of the Financial Derivatives Company Limited, underscored the importance of these reforms, noting that they were essential in preventing impunity and ensuring that Nigeria’s financial system operated with greater discipline and integrity. Speaking on Arise Television’s Global Business Report, Rewane praised Cardoso’s commitment to institutional reforms, stating that they were crucial for long-term financial stability.

Under Cardoso’s leadership, the CBN has taken decisive steps to ensure that Nigerian banks are well-capitalized and resilient enough to support economic growth. Recognizing the importance of robust capital buffers, the CBN announced in November 2023 that banks must meet new capital thresholds by March 2026. Banks have been required to either issue new equity, merge with other institutions, or adjust their licenses to comply with the updated capital requirements.

This recapitalization effort is intended to strengthen the banking sector’s ability to withstand economic shocks, absorb loan losses, and provide sufficient liquidity to the broader economy. With increased capital, banks will be able to underwrite larger levels of credit, support more significant projects across various sectors, and ultimately drive higher income.

According to Ayodeji Ebo, managing director and CBO of Optimus by Afrinvest, the recapitalization program will enable Nigerian banks to take on bigger risks, bolster investor confidence, and ensure the banking system remains resilient in the face of future economic challenges.

Ebo also highlighted the fact that stronger capital positions would likely lead to lower lending rates in the medium to long term, which would further stimulate economic growth.

Cardoso has also placed emphasis on enhancing regulatory oversight and expanding financial inclusion. In the past year, the CBN under his leadership has approved new licences for a variety of financial institutions, reflecting a commitment to strengthening the banking and finance sector.

Notably, a merchant bank transitioned to a national commercial bank, while two banks received approval in principle (AIP) for regional commercial licenses. Additionally, another institution was granted AIP for regional non-interest banking, a move aimed at diversifying Nigeria’s banking landscape and fostering financial inclusion.

Moreover, 16 new microfinance banks were licensed, while 53 previously revoked licenses were reinstated, providing a significant boost to the microfinance sector. These licensing activities are crucial in promoting financial inclusion, especially in underserved regions of Nigeria, as they expand access to financial services for individuals and businesses alike.

The finance company segment has also experienced growth, with five new firms receiving approval to commence operations. These developments reflect Cardoso’s focus on improving access to financial services across Nigeria, particularly for the unbanked and underbanked populations.

One of the hallmarks of Cardoso’s administration has been his emphasis on collaboration with other financial regulators. Through the Financial Services Regulation Coordinating Committee (FSRCC), the CBN has fostered regular inter-agency meetings to address issues ranging from cryptocurrency regulation to infrastructure financing. This improved coordination has contributed to a more cohesive regulatory environment, reducing potential risks to the financial system and promoting sustainable growth.

The CBN has also been a key player in the development of Nigeria’s fintech sector, which has seen significant growth in recent years. Cardoso’s administration has worked to strike a balance between fostering innovation and ensuring that the financial system remains secure. New regulations have been introduced to address the risks posed by emerging technologies, including stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for digital wallets and fintech products.

Additionally, the CBN has collaborated with the Nigerian Climate Change Council to develop a carbon market framework aimed at attracting sustainable finance and foreign investment. This initiative positions Nigeria as a leader in green finance, offering new opportunities for investment while contributing to global efforts to combat climate change.

Under Cardoso, consumer protection has been elevated to priority. In February 2024, the CBN conducted a comprehensive review of consumer protection regulations, focusing on the risks posed by fintech solutions. Following this review, the CBN implemented a risk-based examination approach to identify potential policy gaps and improve the conduct of financial institutions.

The apex banking sector regulator also made significant strides in resolving consumer complaints. Available data shows that between February and October 2024, the CBN addressed 19,988 customer grievances, facilitating refunds amounting to over N7.05 billion and $714,569.03. These efforts demonstrate the CBN’s commitment to ensuring fair treatment for all customers in the financial system.

Digital transformation has been a key focus of the Cardoso administration. The CBN introduced the Unified Complaints Tracking System (UCTS) to streamline the resolution of consumer complaints, and the USSD platform (*959#) was launched to verify the legitimacy of financial institutions. These innovations have improved service delivery and made it easier for consumers to interact with the banking system.

In June 2024, the CBN launched the Women Entrepreneurs Finance Initiative (We-FI) Code, an initiative aimed at closing the gender gap in financial inclusion. This program seeks to improve access to financial services for women-owned micro, small, and medium enterprises (MSMEs), positioning women as key drivers of economic growth.

Furthermore, the rise of digital financial services has brought new challenges, particularly in the areas of money laundering and cybersecurity. To address these risks, the CBN under Cardoso’s leadership adopted ISO 27001 standards and introduced a Risk-Based Cybersecurity Framework to improve the resilience of financial institutions.

Additionally, the bank revised its AML and Counter-Terrorist Financing (CFT) regulations to include Virtual Assets Service Providers (VASPs), ensuring that the financial system remains protected from illicit activities while allowing for innovation in the fintech space.

Cardoso’s administration also placed a temporary restriction on the opening of new accounts as part of broader efforts to prevent fraud and enhance governance. Moreover, the CBN has promoted greater transparency and disclosure within the fintech sector, ensuring that consumers and investors are adequately protected.

One of the most critical areas of focus for Cardoso has been controlling inflation and stabilizing Nigeria’s economy. Inflation had been a persistent problem prior to his tenure, with prices for goods and services rising at unsustainable rates.

In response, the CBN under Cardoso adopted a contractionary monetary policy stance, raising the Monetary Policy Rate (MPR) to 26.75 percent. This move, along with adjustments to the Cash Reserve Ratio (CRR) and Liquidity Ratio, has been instrumental in slowing inflation.

Between February and June 2024, inflation momentum notably slowed from 6.02 percent to 0.71 percent, according to data from the National Bureau of Statistics (NBS). By August 2024, the year-on-year reduction in headline inflation stood at 32.15 percent, offering a glimmer of hope for the Nigerian economy as it strives for price stability.

Conclusion

Although experts say transmission of monetary policy decisions takes some time as the bank marks the one-year anniversary of Olayemi Cardoso’s tenure as CBN Governor, it is clear that the Nigerian financial system has undergone significant reforms.

From addressing the fragmentation of the FX market to driving innovation in fintech and enhancing consumer protection, Cardoso’s leadership has brought about profound changes.

Looking ahead, the CBN’s focus will remain on strengthening the banking sector, promoting financial inclusion, and ensuring a resilient financial environment that can support sustainable economic growth. Cardoso’s administration has laid a solid foundation for the future, and as global financial landscapes evolve, the CBN under his leadership is well-positioned to navigate the challenges and opportunities that lie ahead.

Cardoso’s commitment to reform, transparency, and innovation has earned him recognition as a transformative leader at the helm of Nigeria’s central bank. As he continues to steer the CBN, the Nigerian financial system is poised for continued growth, stability, and prosperity in the years to come.

READ ALSO: Borno flood: Maiduguri faces growing health crisis