The Civil Society Legislative Advocacy Centre (CISLAC) has issued a strong call for immediate action to tackle the pervasive issue of illicit financial flows (IFFs) in sub-Saharan Africa.

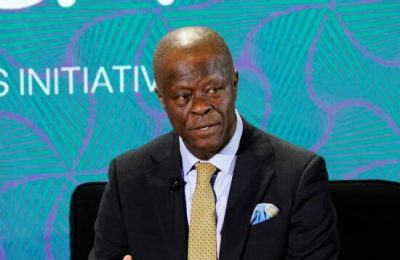

This appeal was made during the launch of the CISLAC report titled “Shadow Networks: The Enablers of Illicit Financial Flows in Sub-Saharan Africa Jurisdictions” by its Executive Director, Musa Rafsanjani, on the sidelines of the United Nations General Assembly in New York on Monday.

The report highlights the key enablers of IFFs and presents comprehensive recommendations to combat this growing problem.

Rafsanjani emphasized the devastating impact of IFFs on African economies, particularly in Nigeria. He noted that billions of dollars that should be allocated to critical sectors like education, healthcare, and infrastructure are instead funneled out of the continent through clandestine networks. “Africa’s abundant resources are being drained by shadow networks, leaving behind weakened economies and deepening inequality,” Rafsanjani stated.

The report underscores that the enablers of IFFs are not only found within financial institutions but also in non-financial sectors. Lawyers, real estate agents, customs officials, and corporate service providers were identified as key actors, knowingly or unknowingly facilitating the laundering of illicit funds. According to the report, these actors provide a veil of legitimacy, allowing illegal funds to blend seamlessly into the legitimate economy.

In response, CISLAC has laid out eight key recommendations to curtail the influence of these networks and restore financial integrity across Africa. They stress the importance of enhancing political will, urging African leaders to show unwavering commitment by ensuring that anti-corruption agencies operate independently and without political interference. Governments are also encouraged to strengthen legal frameworks by introducing more robust anti-money laundering (AML) and counter-terrorism financing laws that cover both financial and non-financial enablers of IFFs.

The report recommends promoting public sector integrity through stronger asset declaration and transparency measures to hold public officials accountable, which is a crucial step in reducing corruption. Additionally, it advocates for improving transparency and accountability by leveraging digital technologies, such as e-procurement systems and advanced financial intelligence, to reduce corruption, especially in government contracts and procurement.

Regulating non-bank financial institutions is another key recommendation, as non-banking entities like real estate firms and art dealers must be held to the same regulatory standards as traditional financial institutions, conducting due diligence and reporting suspicious transactions. CISLAC also emphasizes the need to leverage technology by investing in artificial intelligence, blockchain, and data analytics to track illicit funds and enhance the effectiveness of Financial Intelligence Units.

The report calls for fostering stronger cross-border cooperation to prevent any jurisdiction from becoming a safe haven for illicit financial flows. It also highlights the importance of supporting African-led research to understand the unique enablers of IFFs in Africa and develop tailored solutions.

Rafsanjani stressed the need for collaboration across governments, financial institutions, civil society, and the private sector to dismantle these networks. “We must recognize the gravity of this challenge and commit to sustained action. Only through collaboration and relentless effort can we defeat the enablers of IFFs and secure a prosperous future for our continent,” he urged.

The CISLAC report, supported by the European Commission through the Rallying Efforts to Accelerate Progress – Africa Inequalities Initiative (REAP), offers a detailed look into how shadow networks operate in sub-Saharan Africa, with a focus on Nigeria as a case study. It calls for a comprehensive approach to tackling both financial and non-financial enablers of illicit financial flows.

Rafsanjani called on African leaders to act swiftly and decisively, adding: “The time for action is now. We must turn the insights from this report into strategies that rid Africa of the shadow networks siphoning off our continent’s wealth and secure a brighter, more equitable future for all Africans.”