Government at all levels must tame the scourge of lingering insurgency, kidnapping, and banditry with the severe and far-reaching consequences for the economy, in addition to evolving robust cooperation between the fiscal and monetary authorities to succeed in any viable effort to tackle the prevailing food crises in the nation, writes JOSEPH INOKOTONG.

Nigerians are renowned for their resilience when faced with formidable odds but the current food insecurity and runaway inflation in the country seem to have conspired to overstretch their limits.

People no longer talk about prices of basic food stuffs like tomatoes and pepper again because of their high rate of fluctuation within a short pace of time. In most cases, goods sold at a particular price in the morning often go up by noon or evening, depending on the sellers. What occupies the attention of many Nigerians is how to trudge on, and make do with the affordable while clutching on hope – that things will get better in the near future.

Experts have attributed the rise in prices of key food commodities in the Nigerian market mostly to the lingering insecurity, high cost of transportation of products, climate change and the instability of the exchange rate of naira.

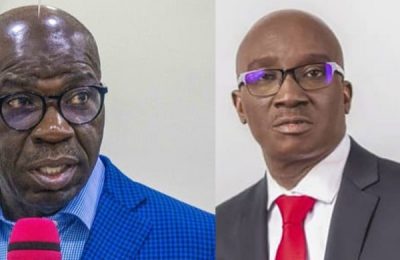

In some aspects, things have started looking up, according to the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso. Inflation, which reflects the change in the price of goods and services, has begun to moderate as month-on-month inflation has dropped by 50 percent. “Between February and now, the month-to-month inflation has decreased by 50 percent. I’m confident that in the not too distant future, things will begin to stabilize,” Cardoso said.

Indeed, the headline of month-on-month inflation rate in Nigeria has slowed for a third time in a row in May 2024, perhaps, the clearest indicator yet that the CBN’s monetary policy tightening measures enacted this year are having the intended effect.

Headline inflation decelerated in May to 2.14 percent from a month earlier, slowing from 2.29 percent in April and 3.02 percent in March, according to the National Bureau of Statistics (NBS). The monthly rate has declined from as high as 3.12 percent in February.

Reflecting a slowdown in price increases for essential goods, food inflation also fell for a third consecutive month to 2.28 percent in May, from 2.50 percent in April, and as much as 3.79 percent in February, the NBS data show.

The monthly inflation trend underscores conviction from members of the CBN’s Monetary Policy Committee (MPC) that a combination of tighter monetary policy and appropriate coordinated fiscal measures from the Federal Government will prove effective in arresting the sharp increase in the cost of living that has afflicted Nigerians since the aftermath of the COVID-19 epidemic.

While year-on-year inflation has continued to inch higher, the monthly numbers that the CBN believes are the all-important indicators isolating the impact since it began raising interest rates in February this year.

“Slowly but surely, the inflation tide is turning,” said Muhammad Sani Abdullahi, Deputy Governor, Economic Policy Directorate at the CBN.

“While the numbers are not yet uniform for all measures, such as year-on-year across the entire country, we will continue to work diligently with coordinated policy measures to ensure that the worst of the inflationary cycle is behind us in the nearest future,” he added.

Year-on-year inflation slowed in May for 13 Nigerian States, including Abuja, AkwaIbom, Borno, Cross River, Delta, Katsina, Ondo, Oyo, and Rivers.

The month-on-month inflation rate decline, which is nationwide, is reflected in a slowing pace of price rises for some food staples, the CBN contends. Cardoso has made tackling inflation his paramount mission as the essential path to achieving sustainable economic growth in the mid- to long-term and improving the standard of living for ordinary people.

Based on available data, inflation has actually fallen month-on-month but in reality, food prices remain high in the market due to a combination of factors.

Food inflation may have fallen for a third consecutive month in May to 2.28 percent, but the grocery bill probably has not, and people should not expect to save money by eating out.

“We have a collision of factors that are impacting food prices,” says Nada Sanders, distinguished professor of supply chain management at Northeastern University. Think about it like waves on the beach, she says. “Some are coming really fast, and some are coming really slow,” Sanders says, “Others are easing and others are still kind of hitting and are about to hit – but it’s a whole host of factors that have an impact and they have cascading effects.”

One of the factors, as highlighted by Cardoso, is the N27 trillion Ways and Means granted by the bank’s former management to the Federal Government, along with N10 trillion in intervention programmes across various sectors. These have been absorbed, leading to hikes in the benchmark interest rate and recent increases in inflation.

“Sadly, we have a situation where a lot of money supply entered the system. We all saw Ways and Means soar to N27 trillion and interventions of N10.5 trillion. This has its consequences. In large part, that is what we are paying for now,” Cardoso said.

Also, on the Foreign Exchange (FX) volatility, which has been blamed for the rising costs of commodities, Cardoso explained that the bank had to correct some dysfunctions in the financial system, such as illicit flows and non-compliance with rules, to ensure market stability. “Sometimes, there is pushback from those who want to continue doing things a certain way. There’salso a need to show people that there will be consistency in our ways before the market will settle.

“There is no more front-loading of FX requests. Even the portfolio investors who left have come back. They were comfortable that there was a plan, and that the plan was headed in a certain direction. These dysfunctions are beginning to smooth out due to the confidence and transparency seen in the markets,” Cardoso said.

Reaffirming that the naira has seen the worst of sharp volatility and is now in calm waters, he added, “A lot of the wide swings were attributed to distortions in the system, but we are beginning to smoothen out as a result of a better understanding of the market, transparency, and doing things right.”

In the same vein, insecurity is another contributor to Nigeria’s food crisis. The security threats not only undermine national stability and the rule of law but also have adverse effects on the economy, affecting price, output, employment, trade balance, poverty, inequality, defense expenditure, government budget patterns, socio-political environment, and several others.

The high level of insecurity in the country, particularly in the northern region, has become a threat to business activities. The lack of security continues to deter prospective investors from engaging in business activities in these areas, leading to a stagnation of commercial operations with the attendant consequences.

The scourge of lingering insurgency and banditry has severe and far-reaching consequences for the economy of the affected areas, and the incessant activities of bandits have created a pervasive sense of fear and insecurity, directly impacting economic activities and development in the region.

Given the region’s predominant reliance on agriculture as the cornerstone of its economy, the presence of bandits has disrupted agricultural activities, as farmers are often afraid to cultivate their fields due to the risk of attacks. This disruption has led to a decline in food production, threatening food security for millions of people. The displacement of people has also resulted in the abandonment of farmlands, exacerbating the food crisis, according to BugetIT.

Banditry has forced many people to flee their homes, abandoning businesses and livelihoods. The economic displacement of individuals and communities has created a ripple effect, affecting local markets, small businesses, and overall economic productivity.

While the north may be considered a hotspot for insecurity, there is a troubling trend emerging in the south, where security crises are gradually encroaching, posing a new set of challenges for the region. This has already affected businesses and farming in the region.

Also, abduction for ransom has become the new money-making venture for kidnappers. This surge in abductions has instilled a pervasive sense of fear and uncertainty among the populace, with many feeling increasingly vulnerable to such threats.

The impact of insecurity on the economy is multifaceted and deeply concerning. Addressing the security situation is imperative, not only for the population’s safety but also for the economic stability, food security, and development of the country.

Interestingly, the Federal Government has unveiled measures to tame the high food prices in the country. It outlined other measures as “strengthening and accelerating dry season farming nationwide, embarking on aggressive agricultural mechanisation to reduce drudgery, lower production costs, and boost productivity, collaborating with sub-national entities to identify irrigable lands and increase land under cultivation.”

The series of strategic measures to address the high food prices currently affecting the country will be implemented over the next 180 days: “150-day duty-free import window for food commodities; suspension of duties, tariffs, and taxes for the importation of certain food commodities through land and sea borders. These commodities include maize, husked brown rice, wheat, and cowpeas.”

The government explained that: “Imported food commodities will be subjected to a recommended retail price. We understand concerns about the quality of these imports, especially regarding their genetic composition. The government assures that all standards will be maintained to ensure the safety and quality of food items for consumption.”

The measures taken by the government so far are laudable but cannot on their own tackle the prevailing high cost of food items in the country without addressing adequately the causative factors. It requires the cooperation of both the fiscal and monetary arms of the government for any viable effort to succeed.

ALSO READ: Lagos: Police arrest ASP over alleged defilement of 17-year-old girl