The Federal Government of Nigeria and the Anambra State Government in collaboration with the International Fund for Agricultural Development (IFAD)’s Value Chain Development Programme (VCDP) partner with Financial Institutions to address farmers’ need for credit facilities.

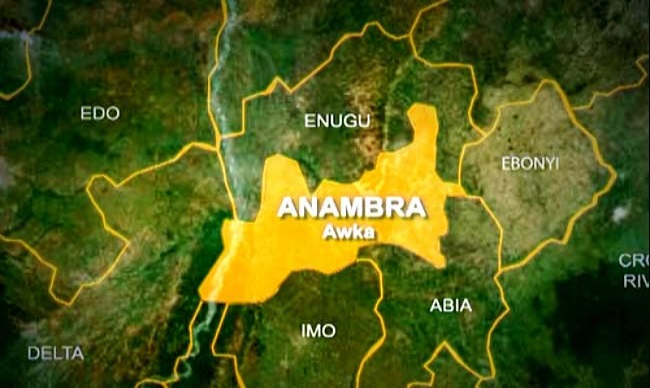

This initiative was disclosed by the State Programme coordinator, Mr. E. N. Agwuncha, during the just concluded 2-day meeting workshop held in Awka, on Friday.

Mr. Agwuncha explained that the meeting was geared at strengthening the partnership between the Programme and Financial Institutions to develop financial products or adjust existing ones to address farmers’ needs as the Programme draws closer to its end.

He pointed out that under this initiative, a survey was conducted to understand the needs of farmers as well as the products available with the financial institutions for farmers to access while ensuring there is no conflict of interest.

Earlier, the VCDP Rural Finance Officer (RFO), Mr. Chukwujekwu Obianefo, in an interview, said that this would be a pilot stage financial inclusion initiative of the Programme for next year, adding that partnership with the financial institutions would consolidate the objective of the Programme in the state.

Mr. Obianefo also said the partnership will in turn build a solid relationship between the institutions and the farmers towards developing a fresh product or adjusting existing ones as would be discussed in their board meeting to ensure a sustainable plan for the Programme exists.

The resource person, Dr. Johnpaul Onyekanaeso, in a paper presentation enjoined the financial institutions to always equip themselves with knowledge on the agricultural field and their audience, the farmers.

He said, “Staff training requires you – the institutions – to have a good knowledge of agriculture in different crops as well as the best approach to handling farmers so as not to jeopardize the objective of the Programme.”

He explained that farmers are now smart and require smarter ways and technicality in dealing with their needs, hence credit facilities.

The financial institutions in attendance include; Monarch MFB, Ihiala micro-finance, LAPO MFB LTD, Oraukwu MFB, and Easy Access MFB.

READ ALSO FROM NIGERIAN TRIBUNE