The Federal Government (FG), has disclosed that it has no intention to borrow from any local or foreign organisation with the removal of subsidy on petrol and exchange rate harmonisation.

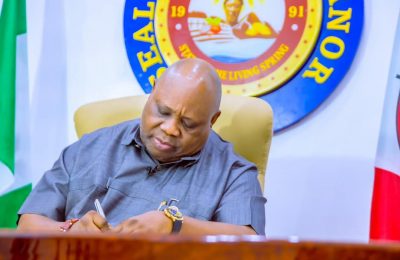

The Minister of Finance and Coordinating Minister for the Economy, Wale Edun, revealed this at the end of the inaugural Federal Executive Council (FEC) meeting in Abuja.

“The federal government is not in a position to borrow at this time,” Edun said.

According to him, the benefit of the subsidy removal would be ploughed back into various sectors aimed at boosting government revenue and improving the business environment for local and foreign investment.

Edun said that with the increased revenue from subsidy removal, various palliatives have been made available to cushion its effect on a short, medium and long-term basis.

He further reiterated the President Bola Ahmed Tinubu-led administration’s desire to take the economy out of the woods it has found itself over time.

“Essentially, we went through an exercise of looking at where things stood regarding the economy, the growth rate, the exchange rate, inflation, unemployment and so on.

“The overriding conclusion is that we are not where we should be, and we also examined the president’s eight-point agenda, that is, the eight priority areas for moving the Nigerian economy forward and for delivering to Nigerians, and those are basically food security; ending poverty, economic growth and job creation, access to capital, particularly consumer credit, inclusivity in all its dimensions, particularly as regards youths and women, improving security, improving the playing field on which people and particularly companies operate, rule of law, and of course, fighting corruption.

READ ALSO: Tinubu Bars Govt Officials With No Duty At UN General Assembly From Travelling To New York

“It is around those matrix that the plans and the targets of what will be delivered in the next three years or so were identified, discussed, and inputs were given by various ministers, and we’ll now go away with the marching order to refine further the targets in particular and within weeks to start rolling out policies and programmes to turn around the economy and make things better for all Nigerians. That really is the substance of what the discussion was all about,” he said.

The ex-investment banker, who was special adviser to Tinubu on monetary policy before his appointment as minister, said he will focus on fixing Nigeria’s public finances.

He added that the government’s naira revenues have increased from crude oil proceeds following a devaluation in June.

“The federation earns dollars and if those dollars are feeding through, at let’s say, 700 naira or 750 naira or so to one dollar as opposed to 460 naira where it was before. Clearly, that is repairing the finances of government,” Edun said.

“So, that’s the plan.”

Reacting to this, socio-political commentator and former Kaduna Central lawmaker, Shehu Sani, said in a post via X that, “It’s relieving to hear from the Finance Minister that the FG has ended borrowing from both local and international sources. Now the task is how to get out of the pit of the debt left behind by the Buhari regime.”