Joseph Inokotong – Abuja

The Federation Account Allocation Committee (FAAC), at its meeting, shared a total sum of N750.174 billion to the three tiers of government, as Federation Allocation for the month of January 2023.

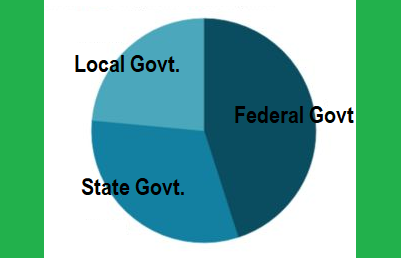

From this stated amount, inclusive of Gross Statutory Revenue, Value Added Tax (VAT), Electronic Money Transfer Levies (EMTL), Augmentation from Non- Mineral Revenue, and an additional sum of N15.000 billion from Savings, the Federal Government received N277.334 billion, the States received N244.975 billion, the Local Government Councils got N180.135 billion, while the Mineral Producing States received N32.730 billion as Derivation, (13% of Mineral Revenue).

In a statement issued on Monday night by Chukwu Helen Oby Ag. D (Information/Press), Federal Ministry of Finance, Budget and National Planning, she said the balance in the Excess Crude Account (ECA) as, at February 20th, 2023 stands at $473,754.57.

According to her, the additional N15.000 billion from Savings, according to the Committee at the end of the meeting, will be shared accordingly to the three tiers of government.

The Communiqué issued by the Federation Account Allocation Committee (FAAC), at the end of the meeting, indicated that the Gross Revenue available from the Value Added Tax (VAT) for the month of January 2023 was N250.009 billion, as against N250.512 billion distributed in the preceding month, showing a decrease of N0.503 billion, from this amount, the sum of N10.000 billion was allocated to Cost of Collection, while the sum of N7.200 billion was given to transfers, Savings, Recoveries and Refunds. The remaining sum of N232.809 billion was distributed as follows; Federal Government got N34.921 billion, the States received N116.405 billion, Local Government Councils got N81.483 billion.

Accordingly, the Gross Statutory Revenue of N653.703 billion received for the month which was lower than the sum of N1136.183 billion received in the previous month by N482.479 billion.

From this amount, the sum of N23.494 billion was given to Cost of Collection and a total sum of N241.091 billion to Transfers, Savings and Refunds. The remaining balance of N389.118 billion was distributed as follows; Federal Government received the sum of N189.745 billion, States got N95.227 billion, LGCs received N73.416 billion, and Derivation (13% to Mineral Producing States) got N32.730 billion.

Also, the sum of N13.799 billion from the Electronic Money Transfer Levies (EMTL) was distributed to the three tiers of government as follows; the Federal Government received N1.987 billion, States got N6.624 billion, Local Government Councils received N4.636 billion, while the sum of N0.552 billion was allocated to Cost of Collection.

The Communiqué further disclosed the Augmentation of the sum of N100.000 billion from Non- Mineral Revenue, which was shared accordingly as follows: Federal Government received N52.680 billion, States got N26.720 billion, Local Government Councils received N20.600 billion.

Petroleum Profit Tax (PPT), Companies Income Tax (CIT), Oil and Gas Royalties and EMTL all decreased considerably. Value Added Tax (VAT) decreased marginally. However, Import and Excise Duties increased, albeit marginally.

The Communiqué, further stated that the total revenue distributable for the current month of January 2023, was drawn from Statutory Revenue of N389.118 billion, Value Added Tax (VAT) of N232.809 billion, an Augmentation from Non- Mineral Revenue of N100.000 billion, N13.247 billion from Electronic Money Transfer Levies (EMTL), and an additional N15.000 billion from savings, bringing the total distributable for the month to N750.174 billion.

READ ALSO FROM NIGERIAN TRIBUNE