Nigerians have continued to weigh in on a barrage of regulatory actions being taken on the operations of the Bureau De Change (BDC) segment of the country’s Foreign Exchange Market.

While the Central Bank of Nigeria (CBN) has received commendations in some quarters, it has also garnered a lot of criticisms with most analysts saying that after over 18 years of going back and forth on this sector by the CBN with no significant effect on the exchange rate of the naira, the Federal Government of Nigeria should rather concentrate on structural (dollar supply) problems.

On the other hand, an X user (formerly twitter) Jubril Yasir Arafat hailed the CBN for the latest initiative, saying “only BDCs can enable sustainable Dollar/Naira price in Nigeria. Even the CBN knows this. The restoration of sales of dollars to BDCs will stabilise Naira. Speculators and round trippers will be out of the equation.”

An economists and investment Banking Executive, Mr Nnaemeka Onyeka Obiaraeri, believes that the problem with exchange rate of the naira is ‘corruption demand’ for dollars which the CBN remains handicapped to tackle.

He explained in a viral video seen by Nigerian Tribune that in Nigeria today, between the Federal Government, states and local governments combined, (the three arms of government), there is budget expenditure appropriation of over N45 trillion this fiscal year 2024.

According to him, the truth is that half or more than half of these monies are going to be looted. And when politicians loot these monies, they will use the naira to pursue the dollars.

To him, Nigerians have not taken urgent steps to address the corruption demand for the dollar which is at the root of the country’s problem, stressing that there are instances and empirical examples that he had given in the past of “why we are where we are today.”

He added that politicians are stockpiling the dollars in order to use them for bribery during the next election circle to retain power and continue the looting and some for buying properties abroad.

According to Obiaraeri, these policies that CBN has put in place are neo-liberal classical economic theories that would have worked in economies where 95 to 98 percent of economic activities are captured in the formal sector.

Nigeria does not meet some of the assumptions that drive some of these economic theories that they are putting in place. The solution lies in producing locally, those items that the country imports as well as local refining of petroleum products,

“What they have basically done is to put interest rate at the level that foreign portfolio investors can fly in with hot money and buy CBN treasury bills or CBN bonds.

“There are people in Japan and other places that can take money from banks in their country, as low as one percent or less and all they will need to do is bring in the dollar to swap with the Central Bank of Nigeria. In the next three to six months, they will take it back and pay premium for this.

“Within that period, the CBN can use their dollars to intervene in the market like giving dollars to BDCs for a while and get accolades for stabilising the exchange rate around N1, 500.When the Treasury Bills and Bonds mature, they take back their monies and everything will return to square one.

“This is just like giving Panadol for someone that has headache, the headache is not the symptom, and the person is suffering from a dangerous cancerous growth that is destroying the body. Rather than take away the cancerous growth, perform surgical operations to remove the tumor, you’re busy giving him Panadol to douse the symptoms of the headache, which is the symptom. I don’t know what these guys are up to. What we need to do is to push the supply side of this problem from the physical side. Yemi Cardoso’s instruments will not work” he emphasised.

Also, Professor Ndubuisi Ekekwe, Lead Faculty at Tekedia Institute, a Boston-based business school, believes that the CBN can ban Binance, withdraw licenses or restrict BDCs, dole out several measures but until the country can earn US dollars, the Naira will continue to struggle.

“The problem we are having is not distribution-related, but structural, and that means if we close all distribution channels and refuse to reduce demand (foreign schools, hospitals, toothpicks, etc), the core drivers of the paralysis, the Naira will continue to fade,” he insisted.

In a telephone conversation with Nigerian Tribune, Mr. Ayokunle Olubunmi, Head, Financial Institutions Ratings at Agusto & Co said the rules for the BDCs can only help the naira for a while but it won’t address the market structure, thereby making the effect minimal.

That means without the fiscal side working closely with the CBN, some of these rules may not give 100 percent, the result they are intended to, he said.

He, therefore, called on the Federal Government through the CBN to put appropriate structures in place in BDC sector .

His words, “think about the BDC as the market where people come and buy things. The foreign exchange market has a lot of demand.

“If you don’t address the supply issue, people will always go elsewhere to meet their needs. If the fiscal side complements the monetary, it will ensure that pressure on the naira is reduced.”

Exchange rate differences

The CBN has revoked the operational licences of 4,173 Bureaux De Change (BDC) operators in the country and has resumed dollar sales to operators suspended since July 29, 2021.

In the absence of publicly available information on how CBN sourced the Dollars sold to the BDCs and the cost of acquisition, some analysts are wondering whether the dollar was purchased from NAFEM or sourced from its alleged inadequate forex reserves.

In any case, stakeholders believe that the dollars supplied to BDCs could have been supplied at the market rate to increase the supply side instead of handing over millions of dollars to BDCs and collecting less naira worth, in exchange.

Meanwhile, checks by Nigerian Tribune on the CBN website showed that the weighted average rate of the Nigerian Foreign Exchange (Forex)) was N1,543.581/$1, as of February 29,2024.

Also, at the NAFEM Window on March 01, 2024 the closing rate was N1,548.25/$1. The Nigerian Autonomous Foreign Exchange Market (NAFEM) is the market trading segment for Investors, Exporters and End-users that allows for forex trades to be made at exchange rates determined based on prevailing market circumstances, thus ensuring efficient and effective price discovery in the Nigerian Forex market.

Some analysts argue that since CBN displayed a weighted average of (buying) N1, 543.581/$1 on its website, selling at N1, 301/$1 to BDCs leaves a loss of N242. 581, which translates to another FX subsidy. An amount that would even be higher with NAFEM rate.

This, according to them, is another way of subsidising the naira and bringing up trial and error policies till one works.

Samson Oyeyemi explained that “this doesn’t mean that the Naira is not being floated anymore. It only means that the CBN is also a participant in the market; selling forex. The BDCs could still buy forex at higher rate from other sellers but could only sell at that margin of one percent.”

It should be noted that the CBN says it would be using the lowest spot rate at the NAFEM recorded a day before the release of the dollars to the BDCs, meaning that some weeks, the subsidy will be high, others, it will be lower.

Further reactions

Furthermore, there are concerns that while these measures may offer temporary relief to the foreign exchange market, they do not address underlying economic challenges such as inflation and fiscal deficits.

Another finance expert, Mr. Kalu Ajah questioned the rationale behind the CBN’s funding of BDCs, when currency traders should be marketing to diaspora and tourists among others to get dollars.

“Also why does a BDC need N2 billion capital? What is the reserve for? When I travel I convert at the airport and hotel and those small gift shops. So why can’t all hotels, gas stations, fast food establishments, clubs, churches have BDC license? That’s where the diaspora go. They can collect FX, issue change in Naira and sell that FX to BDC.

“If CBN has restarted selling dollar to BDCs, that is supply, and the dollar will fall and Naira will rise. But it is likened to ‘monetary Viagra’. The CBN is supplying dollar from its very limited FX reserves.

“Best case for CBN, oil output from Nigeria keeps rising and the markets receive incoming inflow of dollars and price naira stronger. Worst case: Exports fall, speculators dare the CBN to keep spending its dollar reserves to defend the Naira, CBN can’t, Naira falls again, ” Ajah wrote in his X (formerly Twitter) handle.

It should be recalled that while resuming weekly forex sales to Bureau de Change operators from August 31, 2020 the CBN pegged naira exchange rate at N386 to the United States dollar. Market watchers said this is similar to the latest N1,314.01/US$ sales peg placed by the apex bank for the $20,000 allocation that it would sell to BDC at N1, 301/$, reflecting the lower band rate of executed spot transactions at the NAFEM as of the previous trading day.

In a 2020 circular to this effect by O.S. Nnaji, the then director of trade and exchange department, the apex bank said its decision to resume forex sales to BDCs is to enhance accessibility to forex, particularly to travellers.

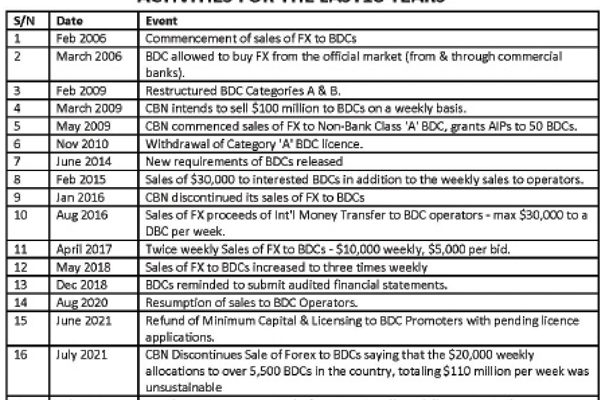

In 2006, the CBN commenced sales of forex to BDCs. In March that year, BDCs were allowed to buy from the official market (from and through commercial banks); February 2009 the CBN restructured BDC Categories A & B and in March same year, CBN pledged to sell $100 million to BDCs on a weekly basis. It commenced sales of FX to Non-Bank Class ‘A’ BDC, grants AIPs to 50 BDCs in May 2009.

Analysts anticipate that these 2024 measures could have significant implications for Nigerian international students. With the Naira facing substantial devaluation against the dollar, the proposed $10,000 yearly limit for international study fees may present challenges as the BDCs are major source of FX for many international students.

According to Professor Ekekwe, in light of the current exchange rate, $10,000 is nearly equivalent to N18 million. This means that Nigerian students may require more than a year to receive sufficient outbound funds to cover their annual school fees, potentially delaying their education plans and increasing financial burdens.

In the recently reviewed guideline, BDCs are required to maintain detailed records of beneficiaries and the amounts sold to each recipient.

The maximum amount permitted for sale per individual is $4,000 for PTA and $5,000 for BTA.

It directed BDCs to prominently display their buying and selling rates at their outlets.

“Transactions by BDCs should only take place at approved office/outlet addresses; street hawking is strictly prohibited.

“Daily reports of Foreign Exchange sales to end-users must be submitted before 10 am the next business day on the Financial Institutions Foreign Exchange Reporting System (FIFX) portal.

“The CBN examination team will conduct periodic spot checks on Foreign Exchange disbursements by BDCs. BDCs must uphold a high standard of professionalism and transparency in line with established guidelines. Any violation will result in immediate revocation of the BDC license,” it said.