The official unveiling of Nigeria’s National Domestic Card Scheme would open

opportunities for the economy to integrate the informal sector, reduce shadow banking, and bring more Nigerians into the formal financial services with attendant diversification of deposit portfolio which will further strengthen the stability of the banking industry.

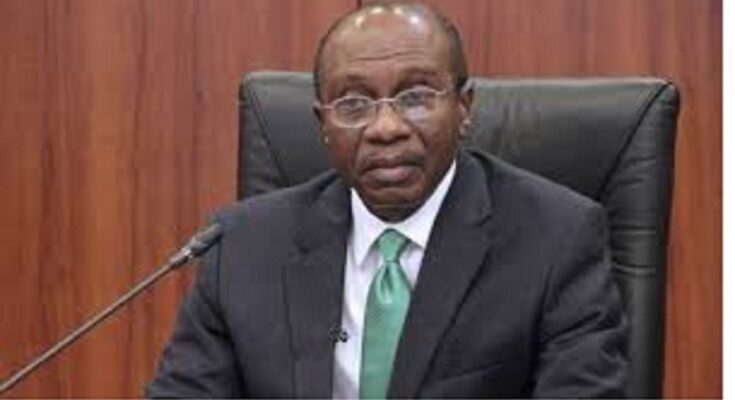

This was stated by Mr. Godwin Emefiele, Governor, Central Bank of Nigeria (CBN) on Thursday in his remarks at the Brand Unveil and Virtual Launch of the Nigerian National Domestic Card Scheme.

He said, “Indeed, the National Domestic Card Scheme bodes opportunities for our economy to integrate the informal segment of our economy, reduce shadow banking, bring more Nigerians into the formal financial services with attendant diversification of deposit portfolio which will further strengthen the stability of the banking industry”.

He pointed out that Nigerians are still excluded, whilst the penetration of card payments in Nigeria has grown tremendously over the years, noting that the challenges that have limited the inclusion of Nigerians include the “high cost of card services as a result of foreign exchange requirements of international card schemes and the fact that existing card products do not address local peculiarities of the Nigerian market”.

According to him, given the limited usage of cards by Nigerians and in a bid to deepen penetration, the Bank actively promoted the National domestic card scheme which will be accessible to all Nigerians and also address the local peculiarities.

Mr. Emefiele stressed that the Scheme is therefore an important plug in the gap that has remained with the country since the cash-less policy was introduced.

“It is important to note that the establishment of National Domestic Card Schemes is in line with global trends. Nigeria, by this initiative, will therefore be joining countries like China, Russia, Turkey and India who have launched domestic card schemes and harnessed the transformative benefits for their respective payments and financial systems, particularly for the underbanked”, the CBN Governor stated.

He explained that the effort is not a quest to prevent international service providers from continuing to provide services in Nigeria. “Rather, it is aimed at providing more options for domestic consumers whilst also promoting the delivery of services in a more innovative, cost effective and competitive manner”.

The National Domestic Card Scheme is another collaborative effort of payment ecosystem stakeholders in Nigeria for the greater benefit of all Nigerians.

Mrs. Aishah. N. Ahmad,

Deputy Governor, Financial System Stability, Central Bank of Nigeria and Chairman, Nigerian Interbank Settlement System (NIBSS) said at the official brand unveiling and launch of the Nigerian National Domestic Card Scheme that the scheme is an “important platform for further innovation to solve some of the most

pressing issues around financial inclusion, SME payments and trade

facilitation primarily, supporting the drive for a robust digital economy for the

Nigerian market the African continent and the world”.

She noted that robust industry engagement and collaboration was critical in getting Nigeria

to this crucial milestone, and acknowledged the Board of Directors of NIBSS, particularly Deposit Money Banks (DMBs) for their role thus far and other participants in the ecosystem for their contributions.