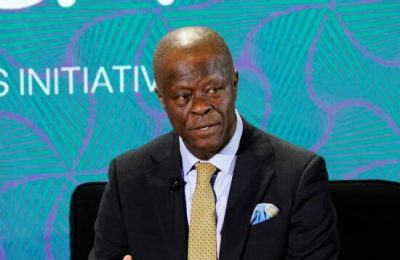

Top financial expert, Tunde Obadero, is the Chief Executive Officer of Zitra Investments, a licensed lending institution that provides a broad range of financial services to help individuals, especially the Micro, Small and Medium Enterprises (MSMEs) industry. He speaks with SEGUN ADEBAYO about the financial sector among other issues in this interview.

YOU have your hands in different pies over the years; from banking to fin-tech where you are now making waves among other commitments. Could tell us how your career has evolved over the years?

The name Tunde Obadero has almost 20 years of experience in the financial sector, having worked with several banks, I have transitioned from traditional banking to fin-tech, starting at Page financials, then running a subsidiary called Pledge Finance, and eventually becoming the Managing Director of CS Advance. Two years ago, some friends and I decided to build our own shop, focusing on serving the bottom of the pyramid where people need us the most

From your dispensation, you mentioned something about MSMEs and how important they are to the GDP. Can you stress more on that?

In Nigeria, MSMEs contribute 49% of the GDP and there are at least 40 million of them. With up to 60 million unemployed adults, supporting MSMEs is crucial to addressing unemployment and poverty. Internet penetration and mobile access create opportunities for banking services, but many people lack the funds to save or transfer. Providing small credit, even as little as N10,000 or N50,000, can be the difference between hunger and having food on the table.

So far your company has been dropping in terms of credit facilities to these small businesses in terms of support and mentorship. How many years has your orgnasiation been committed to this and how can you examine the development so far?

Small businesses drive the economy worldwide, as in America. In Nigeria, MSMEs, including shops, supermarkets, and small manufacturers, contribute to the GDP and employ 5 to 50 people, generating N500,000 to N100 million annually. They are the life line of our economy. Given the challenging times, supporting them is crucial now, which is why we are here

What are the impacts your company has had on the small scale business industry?

Although we’ve only been around for two years, we’ve made an impact by supporting over 12,000 people, two-thirds of whom are small business owners. To further expand and empower individuals and small businesses, we have acquired Zawadi Microfinance bank limited. In addition, we also recently gained our SEC licence approved so as to have more investment products to meet our client’s financial goals. We provide credit and savings solutions, aiming to help businesses thrive and grow sustainably. Our goal is to make a sizable, sustainable impact in the communities where we operate. Currently, we have three outlets in Lagos (Oniru, Oshodi, and Iyana Oba) and plan to expand across the city and eventually the nation.

What are the challenges of running this kind of services to the people?

It’s hard to do business where there are infrastructural challenges. There will always be challenges. For us, it’s our responsibility to look beyond the challenges life put ahead of us. We will not allow the challenges limit us; they are mere footstools to our goals.

We’ve seen you had intentions or already partnering with companies like Interswitch, that’s a tall one. Can you discuss how you are pulling off these deals?

We acquired Ferratum, a Finnish fin-tech company that provided nano loans to Nigerians on the Interswitch platform. We now own that partnership, enabling us to offer quick cash loans through SMS-based USSD platforms with no phone calls or paperwork. We also work with partners like One Pipe, You verify, and Appzone.

In your projection, in the next 10 years what should we be expecting from Zitra Investments?

In the next 10 years, expect us to be at the heart of everything related to financial services in Nigeria and also across Africa. Expect Zitra to be one stop for commercial services not just retail but commercial. Expect Zitra to be the pulse of business development and growth; not only in Nigeria but across Africa. That’s our goal

It is not new that many sectors including the finance are experiencing brain drain at the moment. We have most of our best hands moving out of the country. How do you think Nigeria can deal with this?

Brain drain is a cyclical issue that cannot be solved overnight. Economic downturns have led to brain drain, but improved financial situations can attract skilled professionals back home from the Diaspora, bringing with them valuable competencies, knowledge, and values to improve lives. In the end, it can be a positive development.

Do you think the government can also help with some policies to help the industries?

Real growth will be private sector-led, as government intervention has led to economic slowdown in countries that have received it. The role of government is to give the private sector space to operate and focus on infrastructure, safety, and keeping government services running.

How is Zetra contributing to growth of retail financial services in Nigeria?

Zitra is poised to revolutionize the retail financial services industry by offering a comprehensive one-stop-shop for financial services to small business owners across Nigeria. Our goal is to provide unparalleled value to these businesses by addressing the limitations and high costs associated with bigger banks. By doing so, we hope to make their businesses more viable and ultimately contribute to happier households and a more prosperous society.

READ ALSO FROM NIGERIAN TRIBUNE