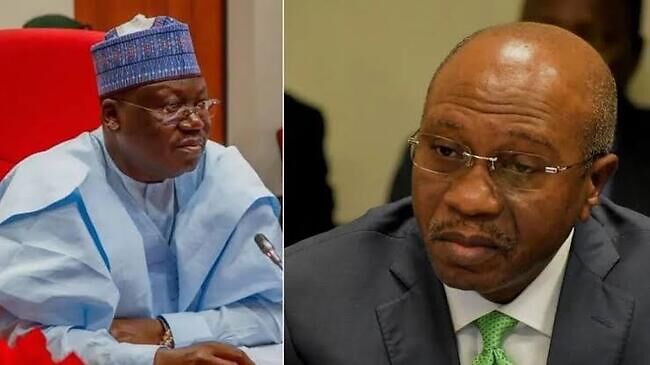

Governor of the Central Bank of Nigeria (CBN) Mr Godwin Emefiele, on Tursday, maintained that the January 31 deadline for the current N200, N500 and N1,000 notes to cease being legal tender stands just as the National Assembly, also on Tuesday, asked the CBN to extend the deadline for six months.

At separate plenaries, members of the Senate and the House of Representatives hinged their calls for an extension on observations that the new notes were not adequate in circulation and that Nigerians were in for chaotic times in a bid to beat the deadline.

The House of Representatives particularly passed a resolution to meet with chief executive officers of Deposit Money Banks over the non-availability of the redesigned new naira notes and the cash swap policy of CBN, on Wednesday.

Earlier in the day, the CBN governor, while addressing journalists at the end of its first Monetary Policy Committee (MPC) meeting for the year, said there was no going back on the policy, appealing to those who still have the old notes to turn them in be- fore January 31.

Thus far, Emefiele said about N1.3 trillion to N1.5 trillion of the old currencies had been deposited with the CBN, expressing hope that about N2 trillion of the old notes will have been deposited by the end of this week.

He stressed that the CBN’s aggressive stance is targeted at containing high inflation by reducing access to credit and mopping up excess liquidity.

Emefiele said: “Unfortunately, I don’t have good news for those who said we should shift the deadline. My apologies.

“We believe 100 days are adequate for people to turn in their old naira notes. We do not see any reason to talk about shift because people could not deposit their old notes.”

The CBN governor hinged his stance on the fact that the apex bank has put in place a number of measures to cater for interest of the people in various categories.

Mr Emefiele cited as an example the unveiling of a cash swap programme in partnership with Super Agents and Deposit Money Banks (DMBs) to enable those in either the rural areas or people with limited access to formal financial services to exchange old naira notes for the new notes.

Senate, House of Reps ask CBN to extend deadline to July 31, House of Reps meets DMBs CEOs today

Tuesday’s renewed call for extension of the deadline follows an earlier one on December 15.

This time, the Senate specifically asked the CBN to extend the deadline for withdrawal of old naira notes from circulation to July 31, 2023.

Senators, while debating on a motion sponsored by Senator Sadiq Suleiman Umar of Kwara State, said if the dead- line was not extended, there would be chaos in many parts of the country.

The lawmakers also ex- pressed dismay that the CBN insisted on the January 31 deadline despite huge public outcry.

It said the six months ex- tension would especially allow those in rural areas more time to change their old notes.

The Senate also urged the CBN to compel commercial banks to open naira exchange windows for those without bank accounts to exchange their old naira notes.

Senate President, Ahmad Lawan, assured that the National Assembly leadership would ensure that its resolution is implemented by the CBN.

Similarly, the House of Representatives called for a six- month extension as well as review of daily withdrawal limit and the charges on them.

Speaker of the House of Representatives, Honorable Femi Gbajabiamila, said the House had concluded plans to meet with the chief executive officers of Deposit Money Banks over non-avail- ability of redesigned new naira notes and the cash swap policy.

The resolution was passed following the adoption of a motion on ‘Matter of urgent public importance on the ‘Need for the Central Bank of Nigeria (CBN) to review the cashless policy and ex- tend the timeframe of the currency swap’ sponsored by Hon. Sada Soli.

In prompt response to various concerns expressed by Nigerians and owners of businesses, the Speaker, Honourable Femi Gbajabiamila constituted an Ad-hoc Committee that will interface with the banks’ chief executive officers today [Wednesday].

Gbajabiamila also harped on the need to meet with the CBN management after the meeting with the banks’ ac- counting officers.

The lawmakers also harped on the need for the apex bank to expedite action on making the redesigned N200, N500 and N1,000 notes available to Nigerians.

To this end, the House called on President Muhammadu Buhari to intervene in the insistence of the CBN on the tight deadline for the implementation of the cashless policy and currency swap.

Gbajabiamila said: “We can all agree that it is a good pol- icy. There is a need to review the policy. I think we need to add another prayer because on one hand, this is the crux of the matter. The banks are saying they don’t have the money; on the other hand, CBN is saying, no you have the money. In fact, we will penalise you if you give out old notes. Go and issue the new notes we have given you. There is a difference. One is saying they don’t have it, the regulator is saying they have it.

“We need to amend and invite the bank MDs, the major ones to brief the leadership or very small ad hoc committee. Let us find out the truth whether this new notes are available. Is it the banks or the CBN?” he said.

CBN raises benchmark interest rate to 17.5%

Tuesday’s press briefing also saw Emefiele announce an increase in the Monetary Policy Rate (MPR) to 17.5 percent from the previous rate of 16.5 percent.

According to him, the in- crease was informed by the rising inflationary trend and the need to check it, pointing out that the option to loosen the interest rate was not considered because of its impact on the apex bank’s previous policies.

He said the tightening of monetary policy was aimed at taming inflation, which has moderated.

On the hike of MPR, Eme- fiele said the committee voted to keep the asymmetric corridor at +100 and -700 basis points around the MPR, and the Cash Reserve Ratio (CRR) at 32.5 percent, as well as the Liquidity Ratio at 30 percent.

The CRR is the share of a bank’s total customer deposits that must be kept with the Central Bank in form of liquid cash, while the bank’s liquidity ratio is the proportion of deposits and other assets they must maintain to be able to meet short-term obligations.

Last December, the National Bureau of Statistics (NBS) said Nigeria’s inflation figure dropped to 21.34 percent from 21.47 percent that was recorded in November after 10 straight monthly in- creases.

It also stated that for the same month, food inflation which is one of the driving forces of headline inflation dipped to 23.75 percent from 24.13 percent recorded in the previous month.

However, the CBN Gover- nor told journalists that the committee welcomed the recent deceleration in the nation’s inflation rates, ex- plaining that the persistence in the policy rate increase over the last few meetings of the MPC has started yielding the expected results.

The decision to further tighten the monetary policy rate was made despite the moderation of the headline inflation rate in December 2022 to 21.34 percent from 21.47 percent recorded in the previous month.

In spite of this, the CBN Governor said a marginal de- cline in the inflation numbers in December is not enough to begin to celebrate.

Highlights of the commit- tee’s decision show that the MPR was increased by 100 basis points to 17.5 percent, and the asymmetric corridor of +100/-700 basis points around the MPR was retained.

The CRR was retained at 32.5 percent, while Liquidity Ratio was also kept at 30 per- cent.

The latest increase in the MPR represents the highest rate in over 21 years, since 2001 when the benchmark interest rate averaged 20.5 percent. This represents the fifth consecutive increment in the monetary policy rate.

“The monetary stance is working in tandem with the new naira note design as well as the reduction in the minimum over-the-counter cash withdrawal.

“This also helps to tighten the negative real returns in the fixed-income market, which had deterred for- eign investments. With the benchmark interest rate at 17.5 percent and an infla- tion rate of 21.34 percent, it brings the real returns to a deficit of 3.84 percent,” Emefiele added.

Hike in MPR to 17.5% bad news for struggling businesses —Economist

Reacting to the latest hike in MPR, an economist at the Nasarawa State University, Professor Uche Uwaleke said: “The hike in the MPR by another 100 basis points to 17.5% is not cheering news for struggling businesses in Nigeria and for output

growth in general.

“In view of the pause in inflationary pressure, declining GDP growth, on-going implementation of cash withdrawal limit which will ulti- mately reduce money supply, and the fact that supply-side factors are major inflation drivers in Nigeria, I had ex- pected the MPC to maintain status quo.

“Following this development, it is expected that the banks will reprice their loans which may further jeopardize their risk assets and worsen asset quality.

“It is obvious that the CBN is heeding the advice of the IMF at the just concluded World Economic Forum where the Global financial body urged Central Banks not to pause their aggressive monetary stance.

“While doing so helps Central Banks to pursue their primary mandate of price stability, it leaves global economies vulnerable to economic recession.

“For Nigeria, it goes without saying that a high interest rate environment is inimical to economic growth, job cre- ation and the stock market”.

Stamp duty is N370billion not N89trillion – CBN

On the raging controversy on Stamp Duty, Emefiele dis- missed as ridiculous claims that the CBN withheld stamp duty proceeds amount to N89 trillion.

A House of Representatives member, Alhaji Muhammed Kazaure, representing Ka- zaure, Roni, Gwiwa, Yank- washi of Jigawa raised the alarm in 2022 of alleged theft of stamp duty proceeds run- ning into N89 trillion.

Emefiele said the total rev- enue collected as stamp duty between 2016 and 2022 is N370,686billion.

He disclosed that out of the amount collected, the Fed- eral Inland Revenue Service (FIRS) had disbursed about N226,441,220,158.88 to the Federation Account, remain- ing the balance of about N144, 234,595,346.40.

Emefiele said: “Total assets of all banks is N71 trillion; total deposit in banks is N44 trillion.

“From 2016 till date, stamp duty collection has amounted to N370,686 billion.

“The Federal Inland Rev- enue Service has disbursed N226.451 billion of the money to the Federation Account Allocation Com- mittee, while the balance of N144,235 billion is in the CBN.

“The highest collection of the stamp is N71 billion, col- lected by First Bank.”

To strengthen the records on Stamp Duty, Emefiele said the CBN has appointed PWC, KPMG and Deloitte to do a forensic audit, noting that “if there is any uncol- lected money, we will force the banks to pay. “If there is any uncollected stamp duty, the banks will pay to the last kobo,’’ he assured.