STAKEHOLDERS in the nation’s economy have called on President Bola Tinubu to rejig his cabinet, focus on job creation, intensify the fight against insecurity, and come up with business-friendly policies, as the administration began its second year in office on Wednesday, May 29, this year.

The stakeholders, comprising the Lagos Chamber of Commerce and Industry (LCCI), the Manufacturers Association of Nigeria (MAN), economic experts and market leaders, noted that while the economy had been in an ‘adjustment mode’ in the first one year of the administration, the government should use the next three years to come up with policies that would enhance the living standards of Nigerians.

For instance, in its assessment of the administration’s first year in office, the Lagos Chamber of Commerce and Industry (LCCI) described the economy as being in an ‘adjustment mode,’ with several factors, such as stubborn inflation, persistent weakening of the naira, supply chain disruption driven by insecurity, and weak production base, defining the outlook at any given time.

The chamber noted that though some bold decisions were taken with sincere intentions of fixing structural deficiencies, such as the removal of fuel subsidies, harmonisation of the official and parallel exchange rates, and adoption of a cost-reflective electricity tariff, among others, it would want a systematic review and evaluation of those policies to enable them to achieve the much-desired outcomes.

Making a comparative analysis of the Gross Domestic Product (GDP), the leading economic performance indicator, of the first quarter of 2024 (2.98%), and 2.31% in the corresponding period of 2023, the chamber argued that for the government’s target of 3.37% to be achieved, it must address issues around power supply, rising cost of production, forex illiquidity and its impact on imported raw materials for manufacturers.

It stated that it would also want the government to make better choices of monetary instruments, and deal with the security challenges that have continued to impede agricultural production and supply chain disruptions.

The chamber also scored the administration low on its fight against inflation, which the it believes has not achieved the desired result; since prices of goods keep an upward trend, with the inflation rate rising from 22.22% in April 2023 to 33.69% in April 2024, recording more than a 10% leap in 12 months.

It observed that several attempts by the Central Bank of Nigeria (CBN) to curb flaring inflation, through the instrument of rate hikes, had consistently increased the benchmark rate, the Monetary Policy Rate (MPR), within the last 12 months, a development, it argued, now makes borrowing costlier and constrained new credit for productive activities.

“This has continued to weaken our production base and impede new job creation in the economy,” it stated.

LCCI believes that to successfully curb inflation, the government must come up with corresponding fiscal intervention, aimed at boosting agricultural production and industrial manufacturing.

It also called for concessionary interventions for SMEs in Nigeria, in the face of shrinking credit to the private sector, to enable them effectively play their roles as the engine of the nation’s economy.

“For the administration to be able to build on its initial successes and foster a more robust and inclusive growth trajectory for Nigeria in the coming years, it must strengthen its monetary policy, enhance revenue generation, continue with its tax reforms and improve compliance to increase government revenue, diversify the economy, improve infrastructure, and invest in non-oil sectors to reduce dependency on oil revenues and build economic resilience.

Need for Manufacturing Bank

Interestingly, one of the sectors worst hit by the administration’s policies in the last one year has been the nation’s manufacturing. Though the sector has continued to show resilience, operators are quick to tell whoever cares to listen that all is not well within the sector.

Though it has some sweet tales to tell, especially with a minimal growth in the first quarter, and a rise from 51.8 to 53.8, in investors’ confidence, as revealed in the First Quarter 2024 MAN CEO Confidence Report; the first time it would be recording such growth, in the last six quarters, manufacturers believe there are a whole lot to be fixed.

Operators in the sector are not without their grouse with some of the policies of the administration in the last one year. For instance, hikes in electricity tariff rates and the interest rates are some of those issues that have continued to draw their ire.

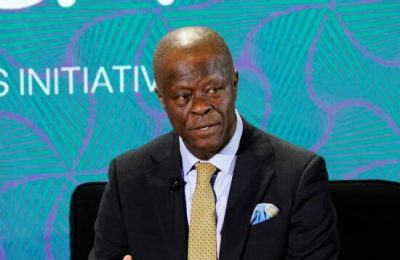

At a public presentation of the MAN CEO Confidence Index Report, Q1, 2024, the President of MAN, the umbrella body of the nation’s manufacturers, Otunba Francis Meshioye, described the recent hike in interest rates by the CBN as a complication of the numerous challenges facing the nation’s manufacturing sector.

According to him, the hike would further worsen some of the challenges of inadequate power supply, insecurity, over-regulation, poor access to credit, poor infrastructure, and low patronage, already bedevilling the sector.

He argued that with the present state of power in the country, over 48 percent of manufacturers’ expenditure are being deployed on alternative energy to enable them stay in business, adding that a further hike in interest rates would leave manufacturers with the two options of either to accept the non-business-friendly policy, and continue to struggle with the high interest rates or shut down.

“With interest rates over 30 percent, the association believes this would only worsen the plights of members, especially those servicing one loan or the other in different banks. And I think the choice manufacturers would be left with, at the end of the day, would be to either take it, and pass some of the costs to the consumers, or go under.

“But no business would want to take the option of going under. They would rather prefer some of the costs be passed down to the consumers. This, at the end of the day, would make such goods become more expensive, and may end up in low patronage for the manufacturers,” he stated.

The MAN boss said it would want those formulating the nation’s policies to always think out of the box in their efforts at finding lasting solutions to the myriad of economic challenges facing the country.

One of such innovations, he added, could be the establishment of a manufacturing bank, to take care of the needs of the sector. This, he believes, would go a long way in solving some of the challenges confronting operators in the sector, while also putting the sector in good stead to perform its role as the catalyst of the nation’s economic growth.

“If we could have a Bank of Industry (BoI) and Bank of Agriculture, I see no reason why we should not have a bank for the manufacturers. The association believes the sector has not been able to maximise its potential because the necessary support that should have come from the nation’s financial institutions is not there.

“To worsen matters, many of these bankers neither understand how the sector works, nor do they understand its potential for the nation’s economic growth. That is why they prefer giving their loan facilities to traders, rather than manufacturers; since they are looking at the short term benefits, not the long term opportunities that the manufacturing sector can provide,” he stated.

He would also want the administration to fix the issue of forex, noting that many of the association’s member companies have continued to struggle, especially the import-dependent ones, because of forex illiquidity.

Food security

Giving his assessment of the Tinubu administration in the past one year, a public analyst, finance expert and Chief Executive Officer, Wealthgate Advisors, Mr. Biyi Adesuyi, believed the administration has not lived up to the expectations of Nigerians in the last one year, as evidenced in different economic indicators.

He, however, believed there is still room for the administration to right some of the wrongs of the first year.

One of such ways, Adesuyi stated, is for the president to rejig his cabinet and show the exit door to some of the ministers, who have not performed in the last one year.

“It would be wrong of us to expect any change in the second year, if the cabinet is still retained. The simple definition of madness is to continue to do the same thing all over, and expect different results. It is obvious we have not seen the much sought-after relief because some of the individuals holding key ministries in the cabinet have not really performed.

“I don’t see the situation changing as the administration goes into its second year, unless there is a rejig that will see the coming on board, knowledgeable people, capable of steering the economy on the right course,” he stated.

A critical area many believe urgently calls for attention is the issue of food inflation being experienced in the country, especially with the figures shown below.

A survey of some markets revealed the astronomical jump in the prices of goods in the last one year, a reason the nation’s food inflation is said to have hit an all-time high of 40.53 per cent on year-on-year basis, marking a significant increase of 15.92 percentage points from the 24.61 percent recorded in April 2023.

A 50kg bag of rice which sold for N35,000 in May 2023 now sells for N80,000; 50kg bag of flour which sold for N28,500 in May 2023 now sells for N50,000; a 50kg of honey beans which sold for N30,000 in May 2023, now sells for N95,000; a bag of onions which sold for N28,000 in May 2023, now goes for N60,000; three tubers of yam sold for N2,000 in May 2023, now sells for N10,000; 50kg of tomato that sold for N40,000 in May 2023, now goes for N150,000; a loaf of bread that sold for N900 in May 2023, now sells for between N1,600 and N1,700; a 50kg of garri that sold for N28,000 in May 2023, now goes for N50,000.

Interestingly, the traders and consumers seem to be helpless. While the consumers are daily complaining about the cost of food prices becoming increasingly inaccessible, the traders believe until the government addresses the twin factors of insecurity and high transport cost, the end to the food crisis in the country is not yet in sight.

Expressing the helplessness of the traders in stemming the tide, the chairman, Mile 12 International Market, Alhaji Shehu Usman Jibril, attributed the situation to insecurity in the country, especially in the northern part of the country, where most of the agricultural produce comes from.

“Hunger is not good for any nation, and that is why we believe the government must act fast. This administration must intensify its fight against insecurity to enable displaced farmers to go back to their farmlands. Many of our suppliers now live in IDP camps, away from their farms, hence this situation. The earlier the problem of insecurity is solved and people are able to go back to their farms, the better for us and the economy,” he stated.

ALSO READ: South Africa election: ANC loses 30-year parliamentary majority