The Central Bank of Nigeria (CBN) has called on bank customers to report any difficulties encountered while withdrawing cash from bank branches or ATMs, effective December 1, 2024.

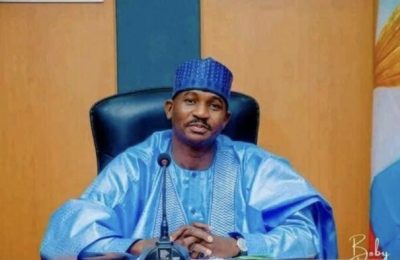

This directive was issued by Olayemi Cardoso, CBN governor, during the 2024 annual bankers’ dinner organized by the Chartered Institute of Bankers of Nigeria (CIBN) in Lagos on Friday.

“Effective December 1, 2024, customers are encouraged to report any difficulties withdrawing cash from bank branches or ATMs directly to the CBN through designated phone numbers and email addresses for their respective states,” Cardoso said.

He further emphasised that financial institutions found engaging in malpractices or deliberate acts of sabotage would face stringent penalties.

Cardoso assured Nigerians that the CBN remains committed to maintaining a robust cash buffer to meet the country’s needs, particularly during high-demand periods such as the festive season and year-end. He said this move aims to ensure seamless cash flow while fostering trust and stability in the financial system.

“The payment system vision initiative for 2025 will further enhance confidence in the nation’s payment system,” the CBN governor noted.

Cardoso also highlighted the CBN’s efforts to improve payment gateways, assuring that delays in settling financial transactions would be addressed by 2025.

ALSO READ: Kogi doctors seek implementation of approved CONMESS salary structure

“Trust is fundamental to fostering digital transactions,” he said, emphasizing the importance of preserving consumer confidence. He noted that delays often disproportionately affect vulnerable populations and warned that the CBN would apply penalties to non-compliant institutions to safeguard consumer trust and ensure swift redress mechanisms.

Key initiatives for 2025 include implementing an open banking framework, advancing contactless payment systems, and expanding the regulatory sandbox. Additionally, the CBN plans to issue revised guidelines for agency banking and strengthen electronic payment channels.

Cardoso also stated that Nigeria is on track to exit the Financial Action Task Force (FATF) grey list by the second quarter (Q2) of 2025. He said enforcement plans against money laundering, cybercrime, fraud, and corruption are being intensified.