•demand statistical data on crude oil production, sales

•Nigeria loses 1% GDP to tax waivers, incentives, import duty waivers — Edun

The House of Representatives on Monday expressed grave concern over the undue increase in the personnel component of Ministries, Departments and Agencies (MDAs) from N4.1 trillion in the 2023 Appropriation Act to N4.79 trillion leaving a difference of N621 billion proposed in the 2024 budget estimates.

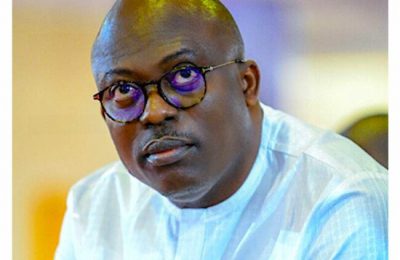

Chairman, House Committee on Appropriations, Hon. Abubakar Bichi expressed the concern in Abuja, during an interactive session with the Minister of Finance & Coordinating Minister of the Economy, Wale Edun on the 2023 budget performance and 2024 budget defence.

Other lawmakers who spoke during the session, demanded statistics on crude oil production and sales as well as the implementation of Steve Oronsanye’s report on civil service reforms with a view to cut down on the high cost of governance.

Bichi who called for a review of the recurrent expenditure, said: “As you are all aware, the sum of 27 trillion has been earmarked for the 2024 budget and 27 trillion may look very big but considering the inflation, exchange rate and all of that, we believe that we really have to look into it to support Mr. President to achieve his 8-point agenda. No matter how Mr. President has to actualize this agenda, he needs some funds and the only way for him to get the money is through all these GOEs, and to see how we can interact with them and how we can have more funding to support Mr. President to actualize his dreams.

“That’s the reason we said, let’s call all the GOEs and honourable Minister of Finance to see how we can move, how we can get more revenue to support Mr. President to actualize his dreams for Nigeria. We believe the budget is perfect and brilliant budget but without funds, it’s going to be a serious problem. So, we need to find a way to increase the funds.”

Speaking on the observed increase in recurrent expenditure for the years 2023 and 2024, Hon. Bichi said: “this document of 2024 budget, we have studied this document very very carefully and very well. We also studied 2023 as well.

“There are some questions I want to ask on personnel per MDA. In 2023, the amount budgeted for personnel of MDAs is N4.139 trillion and from the data that we have, from January to September, N3.1 trillion has been released. If you add 3.9 divided by 9, and want to project from September to December, the actual is going to be N4.1 trillion. So what was budgeted was 4.1 we don’t have any cause for alarm.

“But personnel for GOEs in 2023 it’s 912 billion budgeted, actual releases is 684 billion from January to September based on the information we have. And our projection from January to December is 603 billion so the difference is 309 billion from January to December. That’s number one.

“Number two, the overhead for MDAs, the amount budgeted is 785 billion and the actual release from January to September is 240 billion, our projection from January to December is 320 billion, so that means a difference of 465 billion because what was budgeted is 785 and actual payment is 320.

“Then overhead of GOEs as well. Budgeted is 671 billion, the actual release is 294 billion, and our projection from January to December is 392 billion, the difference is 279 billion. So, if you add everything here you have a lot of money, so are we saying we over-budgeted?

“Number two, in the 2024 budget, the personnel of MDAs is 4.79 trillion, while in 2023, it’s 4.1 trillion; so the difference is 651 billion from 2023 to 2024. So, the difference honestly is wide enough to ask why? Because when we have almost 2.06 trillion in your deficit, that means we over-budgeted the money for recurrent or what? We need more light on that,” Hon. Bichi said.

While responding to various questions from the lawmakers, Minister Wale Edun explained that the 2024 budget estimates seek to “include a reduction of the fiscal deficits from 6.1 per cent to 3.88 per cent and likewise an increase in the capital share of the budget.

“Government revenue as a percentage of GDP is still under 10 per cent compared to the average for the African countries which is nearer 15 to 18 per cent and in some cases is even over 25 per cent. Clearly, the government does not have enough revenue to fund the critical infrastructure.”

While noting that the interest rates a Ross the world remain high, the Minister explained that the present administration is looking away from international market and multilateral sources, rather resolved to look inward.

“So, we would be looking at getting more revenue from across the board of government business, which means the government enterprises, the parastatals as well as looking to private sector investment,” he said.

He also hinted at the revamping of the existing tax administration, without necessarily imposing a new tax regime on the citizens and businesses, but with a special focus on improving revenue collection by blocking leakages through the adoption of relevant technology.

“In terms of tax administration, there is a wholesale comprehensive revamping of tax administration and that is being done through the instrumentality of the fiscal Policy and Tax Reform policy. It has a year to work but throughout that year, it is going to be recommending and having implemented, various improvements.”

“One, as the honourable member, mentioned, the plethora, multiplicity, duplicity and sheer weight of a number of taxes is being compressed, because the research has shown that 90 per cent of the tax revenue that is actually collected into government coffers at all levels actually comes from about nine particular tax heads.

“So, all the rest that are collected under the names of taxes and fees do not reach government coffers. That is a veritable area for creating greater efficiency.”

Edun also lamented that “about one per cent of the GDP of this country is given out in waivers, tax, incentives, import duty waivers and so on and so forth and that system, that expenditure by government needs very serious analysis in order to make sure that items that were relevant years ago or even given out years ago are not now still being given where they are not required and where they are not adding value.

“One of the particular areas is that incentives are often given out up front and with the technology that is available today we are looking to move to a system of rebates. A system of immediate payments so VAT is paid by returns. It first of all goes into private hands and then goes into the government’s hands.

“What we are looking at is a system where the payments at the point of sale, the government’s payment, goes straight to the government. It is possible with the technology we have these days and of course, we can all see how it would create a much more efficient way of collecting government revenue, because if you put it in none government hands before it goes into government, you can expect and probably know that you will get some leakage, some inefficiency in that process.”

In the same vein, Edun disclosed the present administration’s plans to evaluate all Federal assets including Nigerian National Petroleum Corporation Limited (NNPCL) assets for the purpose of sourcing funds from privatisation to finance the fiscal deficit.

He said: “On the first question on the deficit and funding of the deficit when we talk of privatisation I must inform you that I am aware that NNPC for one is looking very carefully at its assets and Ministry of Finance Incorporated is carrying out a very thorough and comprehensive tabulation, valuation and categorization of all the assets owned by the Federal Government.

“Between those two exercises, we should have a robust assets register. We should know what the nation owns by way of assets and what is the value. That is the first step in deciding in which way we can now optimize those holdings.”

On the plans to cut down the high cost of governance, he said: “In terms of recurrent expenditure, the chairman did point out and gave us some insights as to what I would call an over-estimation of certain recurrent expenditure.

“But I think the first thing to say is that if we do not get a hold of government expenditure if we are not able to restrain it and show transparency and accountability and efficiency in government spending, then you lose the trust of the public in whose name you are spending that money.

“So, it is critical that government expenditure is seen to be efficient. That waste is cut to a minimum and leakages and so on and so forth. I think we need to go back and interrogate why in two years there seems to be an overestimation of certain recurrent expenditures and I think it is a very important exercise and we are on the same page with the Appropriations Committee of the House.

“The issue of accounting for oil revenue. It is a very important issue. Clearly whatever is being done, whatever we have met as a way of the process of monitoring the oil revenue, oil sales, oil production and payment into government coffers as required by section 162 of the constitution, work needs to be done there, torch-lights need to be shone.

“At all levels, disquiet has been expressed, you the honourable members have mentioned it today, the commissioners of finance at the federation account allocation committee meetings have expressed it, the Nigerian Governors Forum has said it, so many commentators have pointed out the fact we need to have a robust system identifying the sales, the production, payment into government coffers, the exchange rate, so all those issues are going to be looked at in a comprehensive manner.”

READ ALSO FROM NIGERIAN TRIBUNE