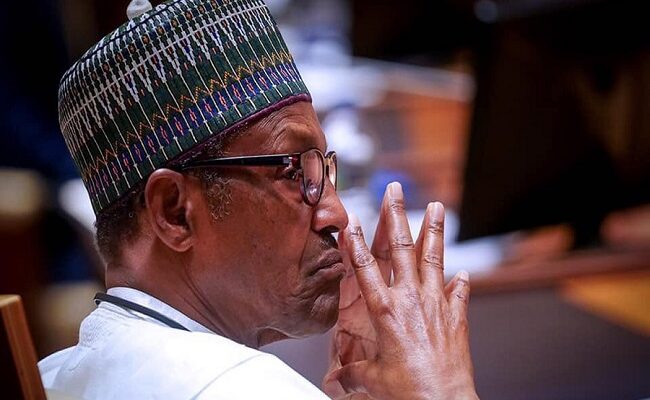

The House of Representatives, on Wednesday, unveiled plans to investigate the Road Infrastructure Development and Refurbishment Investment Tax Credit scheme initiated by the former President, Muhammadu Buhari.

The resolution was passed sequel to the adoption of a motion of Urgent Public Importance sponsored by Hon. Ibrahim Aliyu, who expressed concern over the impacts of the scheme which was established through Executive Order No. 007 in 2019.

In his lead debate, Hon. Aliyu who underscored the need to ensure accountability of public funds, queried the effectiveness of the scheme.

He said: “The House notes that the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme, was established by Executive Order No. 007 in 2019.

“The House recalls that Federal Government then stated that Nigeria needs N348 trillion over 10 years to bridge the nation’s infrastructure gap.

“The House observes that this Tax Credit Scheme, is meant to encourage private sector participation in road infrastructure development Nigeria.

“It allows companies to recover costs incurred in constructing or refurbishing eligible roads as tax credits against their future Companies Income Tax (CIT) liability.

“The House further observes that 5 years after its inception, the scheme’s effectiveness which hinges on the viability and cost efficiency of projects undertaken is yet to be ascertained.

“The House is aware that the selection process and onboarding of beneficiary companies by the Road Infrastructure Development and Refurbishment Investment Tax Credit Scheme Management Committee lacks transparency and clear eligibility criteria.

“The House is also aware that there is limited information on the project evaluation and approval process.

“The House is worried that the tax credit utilization may not align with the scheme’s objectives and therefore not achieving its intended impact on our Nation’s road infrastructure.”

To this end, the House has mandated its Committee on Works to determine the beneficiary’s eligibility and selection process by examining the criteria used by the Scheme’s Management Committee to select participating companies and determine if they align with the scheme’s objectives.

The Committee is also expected to ascertain the impact on Road Infrastructure Development through the evaluation of the impact of the scheme on road infrastructure development in Nigeria.

In the same vein, the Committee is to identify the challenges and limitations faced by participating companies and recommend solutions as well as review the transparency and accountability mechanisms in place to ensure the scheme’s effectiveness.

The House mandated the Committee on Works to urgently conduct an investigative hearing on this Tax Credit Scheme with a view to addressing the above concerns of inefficiency and potential corruption.

READ MORE FROM: NIGERIAN TRIBUNE