Securities and Exchange Commission (SEC), has applauded the Board and Management of NASD PLC on a series of innovations embarked upon by the Exchange to enhance its competitiveness and overall development of the Nigerian capital market.

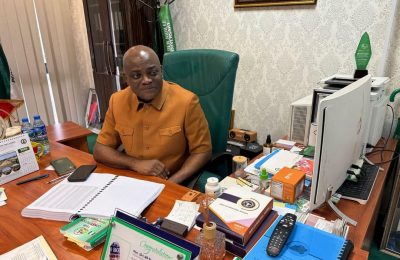

The Chairman, NASD, Mr Kayode Falowo, led a courtesy visit to the new Director General of the Commission, Dr Emomotimi Agama and his team in Abuja recently .

Dr Agama commended NASD for the initiatives, aimed at deepening the digitalisation of its operations. He assured the Exchange of the Commission’s preparedness to support efforts that would develop the Nigerian capital market. He advised NASD to be focused on the specific areas of the market where it wants to operate. “The Commission is committed to diligently promoting innovation in the Nigerian Capital Market within the parameters of existing and potential regulation to facilitate effective development and transformation of the Nigerian Capital Market. I urge the NASD team to be incisive, clear and specific about the areas of the Capital Market they seek to participate in.

“Be rest-assured that the Commission will be true to its mission in supporting innovation that will contribute to significantly developing the Capital Market and the Nigerian economy as a whole. Our drive is propelled by the pronouncement of the Bola Tinubu administration to attaining an economy of a GDP size of US$1 trillion within the next decade,” Agama explained.

Falowo had earlier commended SEC’s new Director General and his Team saying their appointment by President Bola Tinubu, signified placing “round pegs in a round hole.”

“The Capital Market has lofty expectations and confidence in the new team. It is a blend of establishment experience and veritable capital market exposure. This is invaluable to effecting a significant transformation in the market and to the Nigerian economy as a whole,” Falowo stated.

In his presentation, the NASD’s Managing Director and Chief Executive Officer, Mr Eguarekhide Longe, touched on many innovative efforts to strengthen the operations of the OTC Exchange, which include: The establishment of a structured process for supporting growth companies, especially SMEs on the NASD Enterprise Portal – NASDeP.

“This is very useful given the increased in Monetary Policy Rate (MPR) to 26.25% which makes traditional funding sources more expensive and hardly appropriate for the operations of such businesses. We have developed the short-term debt market on NASD, following the approval received from SEC for NASD’s rules for the issuances of Commercial Papers on its market. This is also supporting the growth companies’ strategy. We have finalised the processes for issuances on the NASD Digital Securities (Securities Token Offering – (STO)) platform, cutting across real estate, agriculture real estate, entertainment and creatives and infrastructure assets, involving public private partnerships (PPPs).”, stated Longe.

ALSO READ: Gunmen Attack Anambra Council Secretariat, burn six vehicles