Joseph Inokotong – Abuja

Sterling Bank Plc has signed a partnership agreement with Credit Café Africa, to provide health, education loans and other value-added services to existing and potential customers.

Speaking at the signing ceremony of the Memorandum of Understanding (MoU) between Sterling Bank and the digital lending platform, the Divisional Head for Business Growth and Partnerships at Sterling Bank, Obinna Ukachukwu, said the service would cover operators of nursery, primary, and tertiary institutions as well as hospitals, clinics, pharmaceutical companies, and diagnostic centers, among others.

Customers can receive between N100,000 and N20,000,000 (the single obligor limit under this partnership is N20 million) in financing under the terms of the agreement, depending on the applicant’s financial needs, he added.

Ukachukwu said the bank will start funding the partnership with a first tranche of N10 billion and scale it up in the future.

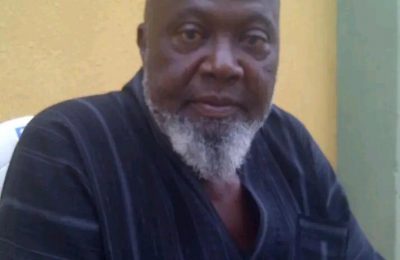

Also speaking at the event, Mr. Louis Gyiman, Founder /CEO of Credit Café Africa, said his company will make it possible for customers of Sterling Bank to have access to finance through the credit facility template in a faster and more efficient manner.

The digital platform streamlines the lending process by offering quick, flexible loans for transforming businesses and providing quick access to quality credit.

Its algorithms determine eligibility and available loan limits, allowing for a faster and more efficient experience.

Gyiman said the facility will enable potential customers to personally monitor everything related to the credit as well as build up credibility in the system, which he described as seamless and effective.

Under its HEART strategy, Sterling Bank has been focusing its investments primarily on five sectors of the economy: which includes Health, Education, Agriculture, Renewable Energy, and Transportation.

READ ALSO FROM NIGERIAN TRIBUNE