In this piece, JOSEPH INOKOTONG chronicles a number of measures the Federal Inland Revenue Service (FIRS) has put in place to cross N10 trillion mark in tax collection, first in the annals of the nation.

PAUCITY of revenue has been acknowledged as one of the major challenges debilitating against rapid economic development in Nigeria since May 29, 2015 when President Muhammadu Buhari assumed office. The volatility experienced in the Oil sector, a major contributor to the nation’s foreign earnings led to a deep plunge in the country’s revenue base thereby forcing the administration in search of alternative sources of viable and sustainable income, aside borrowings.

However, in 2022, the Nigerian economy started to pick up from the downward trend of the past years. There was moderate improvement in the oil industry. The economy still contented with foreign exchange challenges, which inhibited manufacturing and general merchandising. The nation experienced significant cost-pushed inflation during the year. Challenges of inadequate supply of Premium Motor Spirit (PMS), popularly called petrol, and lingering security issues curtailed movement of goods and persons. All of these combined to suppress economic growth.

These economic headwinds, among other factors necessitated a paradigm shift from oil to non-oil sector as alternative source of revenue for the government, and tax collection became a dominant contributor to the poll with the Federal Inland Revenue Service (FIRS) shouldering the huge responsibility.

Indeed, 2022 marked the third year of the current management of the FIRS. Perhaps, three years may not a good point to measure the effectiveness of any administration, but for the FIRS, 2022 is a year of stock-taking in terms of progress of administrative changes, achievements recorded on operational reforms, extent of internal cohesion and solidarity among staff, customer experience as regards ease of tax compliance, and ultimately, revenue collected for the federation.

Oblivious of the enormous task of helping to shore up government’s revenue profile, back in 2020, the FIRS management devoted itself to identifying the statutory, environmental, operational and administrative challenges militating against voluntary compliance and efficient tax administration. The management came up with four points of focus, namely: administrative and operational restructuring ii. Make the Service customer-focused; create a data-centric institution; and automation of administrative and operational processes.

The reforms introduced at different times from 2020 are gradually yielding fruits. By the close of 2022, the FIRS had fully restructured the administration of the Service for maximum efficiency and achieved internal cohesion such that all functional units are working in unison towards the achievement of set goals.

As a result of the conducive environment created for staff, officers of the Service are pulling their weight on the global stage with international recognitions and awards. Most of the administrative and operational processes have been automated. A major leap was the full deployment of the TaxPro for end-to-end administration of taxes in June 2021. The module for the automated TCC went live 1st January 2023, while taxpayers had already downloaded over 1,000 TCCS this year without having to visit FIRS office.

The FIRS has also operationalised data mining and analysis system thereby allowing for data-backed taxpayer profiling; considerably detoxified the tax environment, ridding it of mutual mistrust, negative tax morale, tax evasion, etc. through effective taxpayer education, open engagement with stakeholders and improved services; and set impressive collection records in two consecutive years (2021 and 2022).

The FIRS did not achieve this milestone without surmounting some hurdles on its path. As regards the mandate of the Service, strong opposition against the FIRS persisted in 2022. In 2021, court cases challenging the powers of the Service to collect certain taxes remained unresolved while a couple of new cases came up in 2022. The Management of the FIRS said “these cases are creating a situation of uncertainty and negatively impacting compliance”.

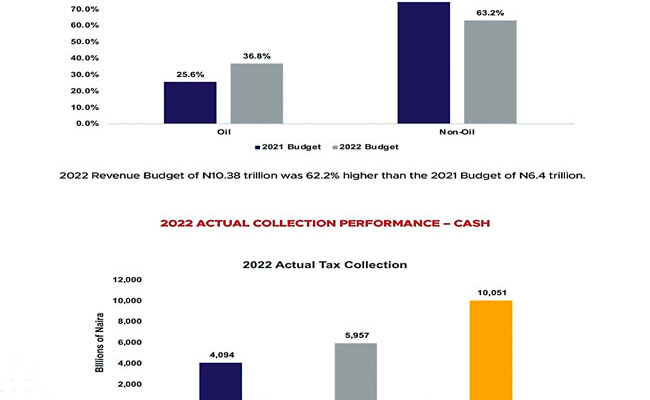

This notwithstanding, the FIRS, in 2022 collected a total of N10.1 trillion, the highest tax collection ever recorded in its history. The amount is inclusive of both oil (N4.09 trillion) and non-oil (N5.96 trillion) revenues as against a target of N10.44 trillion. Companies Income Tax contributed N2.83 trillion; Value Added Tax N2.51 trillion; Electronic Money Transfer Levy N125.67 billion and Earmarked Taxes N353.69 billion. Non-oil taxes contributed 59 percent of the total collection in the year, while oil tax collection stood at 41 percent of total collection.

Johannes Oluwatobi Wojuola, Special Assistant to the Executive Chairman, FIRS (Media & Communication) pointed out that this would be the second consecutive year that the FIRSwill be recording unprecedented tax collection. In 2021, the FIRS achieved a record tax collection of N6.405 trillion, being over 100 percent of its collection target for the year, as well as the first time that the it would cross the six trillion mark. “In 2022, building on the success of the preceding year, the Service achieved a record collection of N10.1 trillion, being over 96 percent of its collection target for the year, and the first time the Service will cross the N10 trillion mark. This collection represents an over 100 percent leap from the tax collected by the Service in 2020, the first year of the current management of the Service”.

Also, certificates for usage of tax credit to private investors and the Nigeria National Petroleum Company Limited (NNPCL) for road infrastructure under the Road Infrastructure Development Refurbishment Investment Tax Credit Scheme created by Executive Order No. 007 of 2019 amounted to N146.27 billion.

In addition to the tax revenue collected, tax waived on account of various tax incentives granted under the respective laws amounted to N1,805,040,163,008.

Providing perspective to this unprecedented tax collection, the FIRS Management noted in its Performance Update that the man who spearheaded the marked improvement in tax revenue, Mr Muhammad Nami-led management upon assumption of office came up with a four-point focus administrative and operational restructuring, making the service customer-focused, creating a data-centric institution; and automation of administrative and operational processes.

While commenting on the N10.1 trillion tax collection achieved under his watch, Executive Chairman, FIRS, Mr Muhammad Nami, said this was possible through “dogged implementation of strategic reforms over the past two years.A renewed commitment by officers of the Service, accompanied with a boosted morale, as well as the innovative deployment of technology for automation of both tax administration and operational processes.”

He stated, “This collection was possible through collaboration with our stakeholders, from our colleagues at the Executive branch of government, to the members of the judiciary, to our brothers and sisters at the National Assembly, as well as the tax advisory committee, professional bodies, unions, and most crucially our taxpayers.”

On the outlook for 2023, Mr Nami noted that the Service would build on the current reforms, achieve full automation and continue to establish a resilient Service that would continue to provide sustainable tax revenue to fund the government. “We intend to maintain, and even improve on the momentum in 2023. We have peaked, but this is not certainly our peak. In fact, my hope is that this would be the least sum the Service would ever collect going forward. Our goal is to identify more areas where we can improve on in the delivery and efficiency of our collection; and plug loopholes, while deploying innovative reforms in data and artificial intelligence.

“Ultimately, we believe that the FIRS can shoulder the responsibility of providing revenue needed for the governments across the Federation to cater for the needs of the Nigerian people through taxes. This is feasible once we get the much-desired support from the three tiers and arms of government, as well as all stakeholders”, Mr. Nami stated.

No doubt, the feat recorded by the FIRS would not have been possible if the stakeholders did not cooperate. This underscores the overriding necessity of working in unison while pursuing common goal for shared prosperity.

Again, in the words of the Executive Chairman of the FIRS: “This collection is as a result of our dogged implementation of strategic reforms over the past two years; the renewed commitment by officers of the Service, accompanied with a boosted morale, as well as the innovative deployment of technology for automation of both tax administration and operational processes. It was also possible through an open-door policy of collaboration with our stakeholders.

“When we came into office, we carried out a full-scale evaluation of the Service to identify the areas we needed to improve in order to transform the Service to a 21st century tax authority. We consequently adopted four-cardinal goals to anchor our reforms. In no particular order, they are rebuilding the institutional framework of the Service, building a data-centric institution, building a customer-centric institution, and lastly to foster and improve stakeholder relations. Since 2020 until date, we have deployed various reforms within the Service around these four-cardinal goals.

“Let me mention some of the key reforms: for instance, we have created a conducive environment for staff to work, and we have prioritised their welfare. Today we can boast of world-class and world-recognised tax administrators in the Service. We have automated most of our administrative and operational processes. It is in this light that in June 2021, we deployed the now famous TaxPro Max, which is an end-to-end tax administration solution that enables taxpayers to register, file returns, pay their taxes, apply for Tax Clearance Certificates, and so much more. Today, a Tax Clearance Certificate that would have taken a taxpayer at least two weeks to process now takes the taxpayer less than one-minute to download via our TaxPro Max.

“Also, data has become a critical tool for tax administration. We set up the Intelligence and Strategic Data Mining Department that is assisting our taxpayer profiling. We are also engaging with our stakeholders and improving our service delivery. Today we have a Contact Centre where taxpayers can phone-in and resolve their issues without visiting our offices physically.”

Analysts say by this sterling performance, the FIRS has contributed its quota in boosting the revenue base of the Federal Government, and called on other revenue generating agency to emulate the Service by embarking on far reaching reforms of their operations to oust opaque practices and enhance effectiveness.