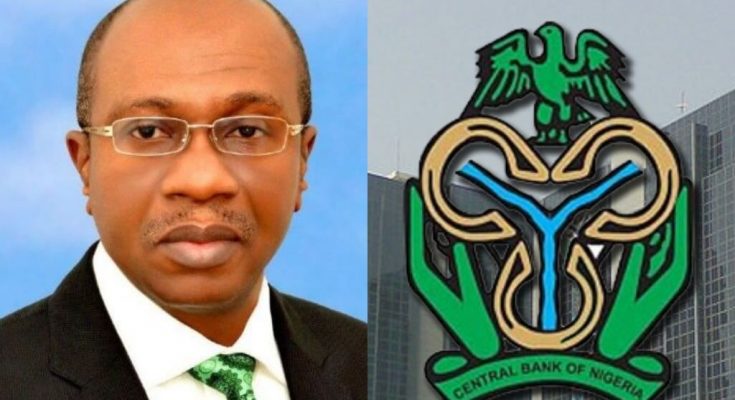

For two and a half years, the Central Bank of Nigeria (CBN) held interest rates at 11.5 percent even through a recession. But with the threat of a global recession, supply chain disruptions, interest rate hikes by Central Banks across the world, the apex bank has increase

Inflation is generally controlled by the Central Bank and/or the government. The major tool used is monetary policy that is changing interest rates. However, in theory, there are other tools it can use to control inflation. These include: monetary policy – Higher interest rates are introduced to reduce demand in the economy, leading to lower economic growth and lower inflation.

There is the control of money supply – some economists are of the opinion that there is a close relationship between money supply and inflation, therefore controlling money supply can control inflation.

Another tool is the supply-side policies – these policies are initiated to increase the competitiveness and efficiency of the economy, thus applying downward pressure on long-term costs. There is the fiscal policy tool –this is a higher rate of income tax which is believed can reduce spending, demand and inflationary pressures and finally there is the wage/price controls tool– which tries to control wages and prices, in the hope of reducing inflationary pressures.

One of the key functions of the CBN is price stability. So, anytime the country is in the grips of inflation, the CBN moves quickly to check it. That is why the CBN has increased interest rates twice in succession, 13 percent in May and 14 percent in July. The interest rate hike is tied to several reasons but for an overriding goal, to check rising inflation.

Inflation in Nigeria as in other parts of the world has been exacerbated by a number of global phenomena. These include: Russia’s military operations in Ukraine which has crippled global supply chain particularly the movement of grains along the Black Sea.

Nigeria as a member of the global financial community has also suffered the consequences of the decision of advanced economies hiking their rates in response to the Ukraine invasion, fallout of the COVID-19 pandemic.

Coming home to Nigeria, the unabating cases of insecurity in all parts of the country have denied farmers access to their farmlands.

Declining global trade, threat to financial stability linked to growing private and public debt profile around the world have fueled inflationary pressures. As developed economies increase their rates, developing economies like Nigeria now have to contend with difficult access to global capital which in turn will lead to economic growth decline.

Confronted with these heightened macroeconomic uncertainties, the CBN has been forced to raise rates first to 13 percent and now to 14 percent.

An economist Dr. Tope Fasua noted that “for more than two years the Central Bank MPC (Monetary Policy Committee) could not move the benchmark rate, MPR from 11.5 percent and it was looking like they were paralysed to go up or to come down and nothing new was happening until they decided to move up the bench rate to 13 percent and now 14 percent.

“They did that in response to the rising inflation rate. Whether this inflation rate is going to come down is a different ball game entirely because since they moved from 11.5 percent to 13 percent what we’ve seen is a consistent rise in the inflation rate which is now at 18.6 percent.”

Fasua believes that “inflation rate will continue to go up because it’s a multidimensional phenomenon and has now become a global phenomenon. There is global inflation and the world is kind of bracing up for maybe another global recession some of this comes from the effect of COVID-19.

“The fact that the government spent money just to keep people afloat without commensurate productivity and so when you spend money in the system like that it has a reverberating effect and it takes a while for the lag to clear up, so people will have money but they are not producing.”

Fasua added that “another thing with the COVID-19 is that apart from the spending they did there was also this idea of work from home and companies closed down, people were laid off, it’s going to take a while for that productivity level to be re-attained, that’s part of what’s going on.”

“In parts of Europe we see a scenario were a lot of people don’t just work anymore they have several companies that are trying to come back but find it difficult to even find staff to employ because people realize that whether they work or not the government will pay, perhaps it was a bit better for them not to work, enjoy their lives and government will pay than to work, get paid paltry amount and then get taxed but if you’re a citizen of many countries the government will pay your rent and give you money to feed and enjoy yourself so they are asking why not,” he explained.

In addition, the dislocation caused by COVID-19 he said now means that “production is more expensive, those who are producing including retailers are having to buy their raw materials at higher prices in Nigeria, we have the COVID-19 intervention scheme contributing from the demand side and from the supply side increased cost of production in every ramification including increased importation given the fact that we are still an import economy so it’s going to take a while for this to clear up.”

The logical thing for MPC to do, he argued “is to continue raising rate I would have thought in the opposite direction but my ideas maybe too radical that when you increase rate while you’re doing it you’re slowing growth you’re asking companies not to expand not to employ not to initiate new ideas and I think in a country like ours what we need is more growth than inflation targeting however we also cannot just watch inflation to keep going.”

Nigeria’s current inflation figures was driven by spikes in core and food components to 15.75 and 20.60 per cent in June 2022, induced largely by the rising cost of production brought on by high energy costs as a result of persistent disruptions to power supply, hike in electricity tariff, continued scarcity of Premium Motor Spirit, and rising price of Automotive Gas Oil.

Professor Micheal Obadan, a member of the MPC, stated that “because of the nature of the current inflation challenge, the hike in MPR is aimed at stemming excess liquidity through the demand side while the supply-side measures implemented through the development finance interventions will continue.”

The rate hike he said “targets greater savings rather than spending and stemming borrowing to finance unnecessary consumption as well as putting pressure on the foreign exchange market.”

“At the same time, it’s expected that the legacy drivers of inflation such insecurity, high energy costs, infrastructure deficits will be addressed to reduce their impact on food inflation. In other words, implementation of complementary measures will make the MPR to work faster and better,” he said.

Going forward, Obadan noted that what Nigerians should expect to see “is gradual deceleration of the inflation rate and reasonably stable prices of goods and services.

“Hence, real incomes/purchasing power will be protected. Ultimately, standards of living should improve with lower and stable prices.”

On whether or not the hiked MPR will stifle real sector growth, the MPC member said that “policies have trade-offs with respect to outcomes. At this point in time, the priority of the Monetary Authority is inflation control.

“But it’s not neglecting the real sector. Real sector operators still have access to dedicated cheap real sector support funds to grow their businesses and support growth and employment.”

CBN interventions

The price increase in the food component was driven by shocks to food prices caused by “continued insecurity in food producing areas and along major access routes across the country; the continued impact of the war in Ukraine on the supply of fertilizer inputs, wheat and other grains; exchange rate pressures; and the impact of monetary policy normalisation on capital flows away from emerging markets.”

The CBN has introduced some measures aimed at maintaining price stability in line with its mandate. These measures have received the approval of some analysts who have expressed confidence in the CBN’s sustained intervention programmes, and like Fasua believe that “inflation is expected to abate as food supply improves and the fiscal authority sustain its efforts to tame the legacy structural challenges which put upward pressure on domestic price levels.”

Over the years, the CBN has rolled out several intervention measures in various sectors of the economy designed to curb inflation in line with its development functions to stimulate the economy and stabilize prices. Some of these intervention programmes are:

Disbursement of over N1.7trn to farmers

The Development Finance Department of the CBN has become the critical nerve centre of the bank. Through the department, the CBN established the Anchor Borrowers’ Programme which was launched by President Muhammadu Buhari in 2015.

The programme has created a linkage between anchor companies involved in the processing and smallholder farmers of the required key agricultural commodities.

The thrust of the ABP is the provision of farm inputs in kind and cash to smallholder farmers to boost production of farm commodities which states have comparative advantage to produce.

Some of these commodities are cereals namely rice, maize, wheat, cotton, roots and tubers namely cassava, potatoes, yam, ginger, tomato, poultry, oil palm, fish, sugarcane among others,

Between May and June 2022, under the Anchor Borrowers’ Programme (ABP), the CBN has released the sum of N3.62bn, as disbursements to 12 projects for the cultivation of rice, wheat, and maize, bringing the cumulative disbursement under the Programme to N1.01trn, to over 4.21 million smallholder farmers cultivating 21 commodities across the country.

Also, the CBN also disbursed N3.72bn to finance three large-scale agricultural projects under the Commercial Agriculture Credit Scheme (CACS). These disbursements brought the cumulative disbursements under this Scheme to N744.32 billion for 678 projects in agro-production and agro-processing.

This brings the total disbursement of the CBN to farmers under the ABP and CACS to over N1.7trn.

The apex bank’s intervention has also helped in the resuscitation of moribund sectors of the economy in line with the present administration’s agenda to diversify the economy from oil as well as preserve foreign exchange.

The CBN governor’s effort towards food sufficiency, especially in rice production, is being tipped to ensure price stability thereby causing rippled positive effects in the economy.

Disbursement of over N2.183trn for real sector projects

As part of its effort to support the manufacturing sector, the CBN disbursed the sum of N113.08bn to 19 new projects under the Real Sector Facility. The funds were utilized for both Greenfield and brownfield projects under the COVID-19 Intervention for the Manufacturing Sector (CIMS) and the Real Sector Support Facility from Differentiated Cash Reserve Requirement (RSSF-DCRR).

Figures obtained from the CBN showed that the cumulative disbursements under the Real Sector Facility currently stands at N2.183trn for the financing of 414 real sector projects across the country.

sed interest rate twice and rightly so to apply the brakes on an inflation threatening to run away. Continue Reading